At Machen McChesney we are committed to Returning Value to you through our monthly e-newsletter, The Value Report.

Here you'll find regular tips to help with your business and personal finances, as well as strategies to grow and more efficiently run your organization.

Table of Content

- The Deductibility of Corporate Expenses Covered by Officers or Shareholders

- Financial Statements: Take the Time to Read the Entire Story

- Biden's Infrastructure Plan: What is Construction's Opportunity?

- As 2020 Draws Near, Taxpayers Should Consider Compliance with Amended Section 174

- Staying Ahead of Potential Changes to Capital Gains Taxes

- Victory for Restaurants: IRS Permits Tips to be Treated as Qualifying Wages for the Employee Retention Credit

- Private Companies: Are You on Track to Meet the 2022 Deadline for the Updated Lease Standard?

- 2021 Federal Tax Legislation? A Review of the Current State of Play

- What's New at Machen McChesney

The Deductibility of Corporate Expenses Covered by Officers or Shareholders

Do you play a major role in a closely held corporation and sometimes personally spend money on corporate expenses? These costs may wind up being non-deductible by an officer and the corporation unless proper steps are taken. This issue is more likely to arise in connection with a financially troubled corporation. Continue reading.

Do you play a major role in a closely held corporation and sometimes personally spend money on corporate expenses? These costs may wind up being non-deductible by an officer and the corporation unless proper steps are taken. This issue is more likely to arise in connection with a financially troubled corporation. Continue reading.

Financial Statements: Take the Time to Read the Entire Story

A complete set of financial statements for your business contains three reports. Each serves a different purpose but ultimately helps stakeholders — including managers, employees, investors, and lenders — evaluate a company’s performance. Here’s an overview of each report and a critical question it answers. Continue reading.

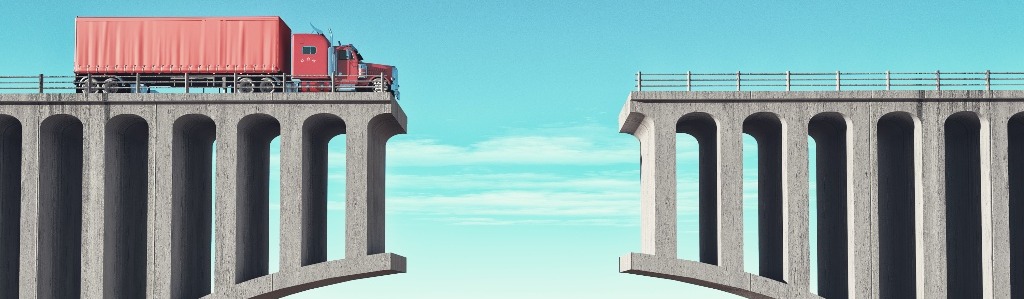

Biden's Infrastructure Plan: What is Construction's Opportunity?

- Infrastructure plan is an opportunity for the industry to improve its reputation

- Construction firms are entering into joint ventures to bid on large projects

- Data analytics can identify labor overages: a case study

President Biden’s infrastructure plan is set to improve failing infrastructure, rebuild the economy and create new jobs. As of this writing, the plan, which Biden originally released on March 31 as a $2 trillion capital injection over 10 years, is a $579 billion proposal that has a bipartisan agreement, though Democrats have signaled the bill may only move through Congress in tandem with larger spending and tax increase package, which they may try to pass via the reconciliation process. Continue reading.

As 2022 Draws Near, Taxpayers Should Consider Compliance with Amended Section 174

Staying Ahead of Potential Changes to Capital Gains Taxes

The greatest wealth transfer in U.S. history is underway. Americans age 70 and older hold an estimated $35 trillion, according to Federal Reserve data.[1] This means that over the next several decades, millions of Americans will be contemplating how to distribute their life savings to heirs, charities, and other beneficiaries. To make matters even more interesting, wealthy Americans also face the potential for a once-in-a-generation increased tax liability. The Biden Administration has proposed increasing taxes on wealthy Americans to raise revenue for various spending initiatives. Continue reading.

Victory for Restaurants: IRS Permits Tips to be Treated as Qualifying Wages for the Employee Retention Credit

By now, most restaurant operators are familiar with the Employee Retention Credit (ERC). As we discussed in a previous blog post, the ERC is a fully refundable payroll tax credit designed to encourage businesses to retain and compensate employees during periods in which businesses are not fully operational. Continue reading.

Private Companies: Are You on Track to Meet the 2022 Deadline for the Updated Lease Standard?

Updated accounting rules for long-term leases took effect in 2019 for public companies. Now, after several deferrals by the Financial Accounting Standards Board (FASB), private companies and private not-for-profit entities must follow suit, starting in the fiscal year 2022. The updated guidance requires these organizations to report — for the first time — the full magnitude of their long-term lease obligations on the balance sheet. Here are the details. Continue reading.

Updated accounting rules for long-term leases took effect in 2019 for public companies. Now, after several deferrals by the Financial Accounting Standards Board (FASB), private companies and private not-for-profit entities must follow suit, starting in the fiscal year 2022. The updated guidance requires these organizations to report — for the first time — the full magnitude of their long-term lease obligations on the balance sheet. Here are the details. Continue reading.

2021 Federal Tax Legislation? A Review of the Current State of Play

As we’ve reported this year, the Biden Administration has made tax policy a legislative priority, and the Treasury Department’s Green Book, released on May 28, provides additional details on these tax policy proposals. Congressional Democrats have also indicated their interest in tax legislation. The question is: Will we see federal tax legislation in the near future? To answer this question, we need to look at the Administration’s and Congress’ infrastructure legislative plans. Continue reading.

As we’ve reported this year, the Biden Administration has made tax policy a legislative priority, and the Treasury Department’s Green Book, released on May 28, provides additional details on these tax policy proposals. Congressional Democrats have also indicated their interest in tax legislation. The question is: Will we see federal tax legislation in the near future? To answer this question, we need to look at the Administration’s and Congress’ infrastructure legislative plans. Continue reading.

What's New at Machen McChesney?

Sponsorships, new hires, announcements

Continue reading.

We hope you found value in The Value Report you've received this month. We look forward to finding even more ways to Return Value to you in the future.

Please feel free to

visit our website or

visit our blog at any time during the month to interact with additional valuable resources and helpful information.

If you have any questions on the topics above, please feel free to

send us a message.

Thanks,

Machen McChesney