At Machen McChesney, we are committed to Returning Value to you through our monthly e-newsletter, The Value Report.

Here you'll find regular tips to help with your business and personal finances, as well as strategies to grow and more efficiently run your organization.

Table of Content

- Help When Needed: Apply the Research Credit Against Payroll Taxes

- Is Your Corporation Eligible for the Dividends-Received Deduction?

- IRS Boosts Standard Cent-Per-Mile Rates for July 1 through December 31, 2022

- How COVID-19 Changed the Life Insurance Industry

- Year-End Planning for the Solar Energy Investment Tax Credit

- Warning for Retailers and Other Businesses Using the LIFO Method

- Construction Ahead: Opportunities and Challenges in 2022

- 2022 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

- What's New at Machen McChesney

Help When Needed: Apply the Research Credit Against Payroll Taxes

Here’s an interesting option if your small company or start-up business is planning to claim the research tax credit. Subject to limits, you can elect to apply all or some of any research tax credits that you earn against your payroll taxes instead of your income tax. This payroll tax election may influence some businesses to undertake or increase their research activities. On the other hand, if you’re engaged in or are planning to engage in research activities without regard to tax consequences, be aware that some tax relief could be in your future. Continue reading.

Is Your Corporation Eligible for the Dividends-Received Deduction?

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” is designed to reduce or eliminate an extra level of tax on dividends received by a corporation. As a result, a corporation will typically be taxed at a lower rate on dividends than on capital gains. Continue reading.

IRS Boosts Standard Cents-Per-Mile Rates for July 1 through December 31, 2022 For the final six months of 2022, the standard mileage rate for business travel will increase by 4 cents per mile, from 58.5 to 62.5 cents per mile, according to IRS Announcement 2022-13. The rate for deductible medical or moving expenses will likewise increase from 18 to 22 cents per mile. Continue reading.

For the final six months of 2022, the standard mileage rate for business travel will increase by 4 cents per mile, from 58.5 to 62.5 cents per mile, according to IRS Announcement 2022-13. The rate for deductible medical or moving expenses will likewise increase from 18 to 22 cents per mile. Continue reading.

Year-End Planning for the Solar Energy Investment Tax Credit

Solar energy is a popular choice for businesses looking to reduce their carbon footprint through alternative energy sources. In addition to supporting a company’s environmental, social, and governance (ESG) strategy, converting to solar energy can potentially lock-in lower energy rates. Further, Section 48 of the Internal Revenue Code provides businesses that invest in solar energy a 26% Investment Tax Credit (ITC) on qualifying solar property placed in service before January 1, 2026 — but only if construction begins on the property before January 1, 2023. Otherwise, the credit is phased down to as low as 10%. Continue reading.

Warning for Retailers and Other Businesses Using the LIFO Method

Recent supply shortages may cause unexpected problems for some businesses that use the last-in, first-out (LIFO) method for their inventory. Here’s an overview of what’s happening so you won’t be blindsided by the effects of so-called “LIFO liquidation.” Continue reading.

Construction Ahead: Opportunities and Challenges in 2022

The Infrastructure Investment and Jobs Act (H.R. 3684) will inject approximately $3 trillion into upgrading and expanding U.S. infrastructure, presenting a long horizon of opportunity for the construction industry. Continue reading.

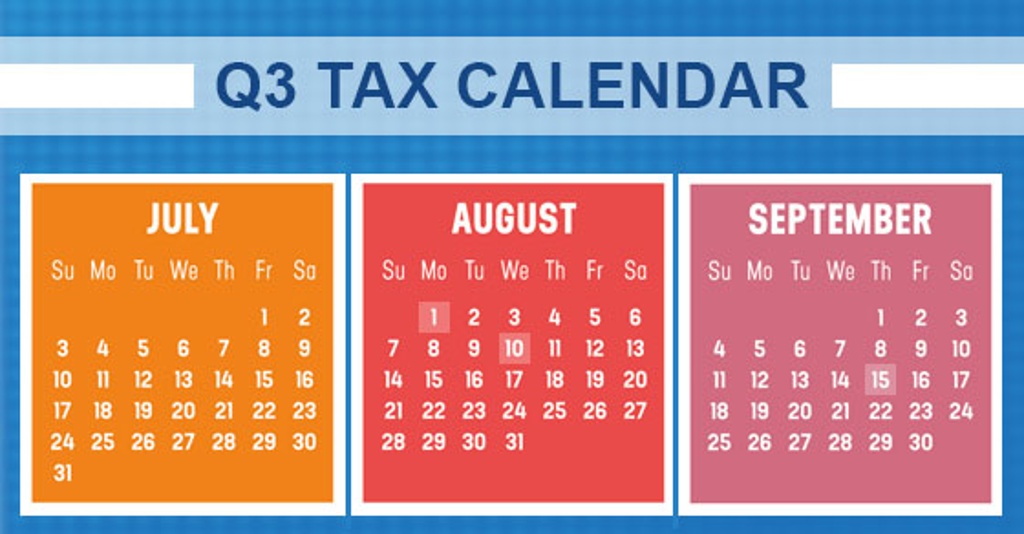

2022 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Continue reading.

What's New at Machen McChesney?

Sponsorships, new hires, announcements

Continue reading.

We hope you found value in The Value Report you've received this month. We look forward to finding even more ways to Return Value to you in the future.

Please feel free to

visit our website or

visit our blog at any time during the month to interact with additional valuable resources and helpful information.

If you have any questions on the topics above, please feel free to

send us a message.

Thanks,

Machen McChesney