Proactive working capital management is essential to successful business operations. However, on average, businesses aren’t managing their working capital as efficiently as they have in the past, according to a new study by The Hackett Group, a digital transformation and AI strategy consulting firm.

Jessica L. Pagan, CPA

Recent Posts

Hiring Your Child to Work at Your Business This Summer

Posted by Jessica L. Pagan, CPA on Jul 02, 2024

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages.

Posted in Business Tax

2024 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jul 01, 2024

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Should You Convert Your Business From a C to an S Corporation?

Posted by Jessica L. Pagan, CPA on Jun 11, 2024

Choosing the right business entity has many implications, including the amount of your tax bill. The most common business structures are sole proprietorships, partnerships, limited liability companies, C corporations, and S corporations.

Posted in Business Tax

It's Almost Time for a Midyear Checkup on Your Company's Financial Health

Posted by Jessica L. Pagan, CPA on May 15, 2024

Interim financial reporting is essential to running a successful business. When reviewing midyear financial reports, however, you should recognize their potential shortcomings. These reports might not be as reliable as year-end financials unless a CPA prepares them or performs agreed-upon procedures on specific accounts.

Posted in Audit & Assurance

It’s not unusual for a partner to incur expenses related to the partnership’s business. This is especially likely to occur in service partnerships such as an architecture or law firm. For example, partners in service partnerships may incur entertainment expenses in developing new client relationships. They may also incur expenses for: transportation to get to and from client meetings, professional publications, continuing education, and home office. What’s the tax treatment of such expenses? Here are the answers.

Posted in Business Tax

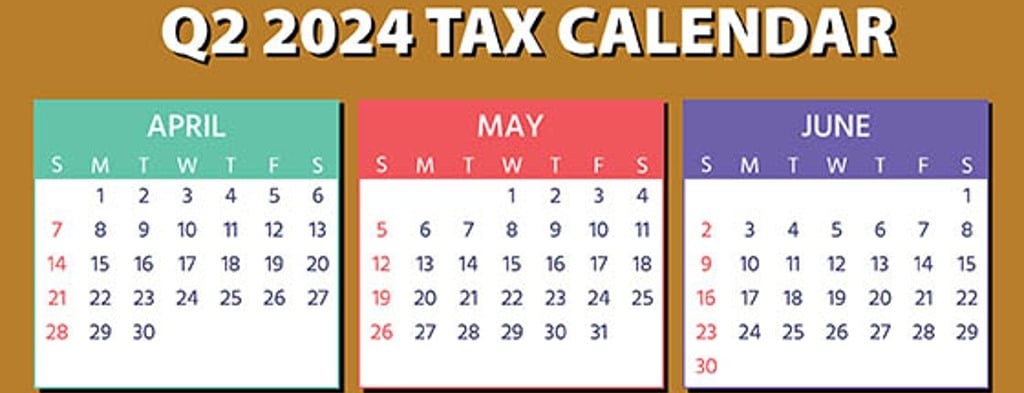

2024 Q2 Tax Calendar: Key Deadlines for Businesses and Employers

Posted by Jessica L. Pagan, CPA on Apr 01, 2024

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Tax-Wise Ways to Take Cash From Your Corporation While Avoiding Dividend Treatment

Posted by Jessica L. Pagan, CPA on Mar 05, 2024

If you want to withdraw cash from your closely held corporation at a low tax cost, the easiest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax efficient since it’s taxable to you to the extent of your corporation’s “earnings and profits,” but it’s not deductible by the corporation.

Posted in Business Tax

Liquidity Overload: Why Having Too Much Cash May Be Bad for Business

Posted by Jessica L. Pagan, CPA on Feb 12, 2024

In today’s uncertain marketplace, many businesses are stashing operating cash in their bank accounts, even though they might not have imminent plans to deploy their reserves. However, excessive “rainy day” funds could be an inefficient use of capital. Here’s a systematic approach to help estimate reasonable cash reserves and maximize your company’s return on long-term financial positions.

Posted in Business Tax

2024 Q1 Tax Calendar: Key Deadlines For Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jan 24, 2024

Here are some key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.

Posted in Business Tax