Determining “reasonable compensation” is a critical issue for owners of C corporations and S corporations. If the IRS believes an owner’s compensation is unreasonably high or low, it may disallow certain deductions or reclassify payments, potentially leading to penalties, back taxes and interest. But by proactively following certain steps, owners can help ensure their compensation is seen as reasonable and deductible.

Jessica L. Pagan, CPA

Recent Posts

Corporate Business Owners: Is Your Salary Reasonable in the Eyes of the IRS?

Posted by Jessica L. Pagan, CPA on May 06, 2025

Posted in Business Advisory

For federal income tax purposes, the general rule is that rental real estate losses are passive activity losses (PALs). An individual taxpayer can generally deduct PALs only to the extent of passive income from other sources, if any. For example, if you have positive taxable income from other rental properties, that generally counts as passive income. You can use PALs to offset passive income from other sources, which amounts to being able to currently deduct them.

Posted in Individual Tax

Ways to Manage the Limit on the Business Interest Expense Deduction

Posted by Jessica L. Pagan, CPA on Mar 05, 2025

Prior to the enactment of the Tax Cuts and Jobs Act (TCJA), businesses were able to claim a tax deduction for most business-related interest expenses. The TCJA created Section 163(j), which generally limits deductions of business interest with certain exceptions.

Posted in Business Tax

2025 Predictions for the Real Estate and Construction Industry

Posted by Jessica L. Pagan, CPA on Feb 13, 2025

Across industries, the last year has been challenging for U.S. companies. Uncertainty around the election, steep inflation, and high interest rates have introduced instability and financial pressures that have taken their toll on the business landscape.

Posted in Business Advisory

A variety of tax-related limits that affect businesses are indexed annually based on inflation. Many have increased for 2025, but with inflation cooling, the increases aren’t as great as they have been in the last few years. Here are some amounts that may affect you and your business.

Posted in Business Tax

There are many tax uncertainties to consider as we face the end of 2024. Chief among them is whether proposals from the new administration will affect our taxes, including changes that may be retroactive.

Posted in Tax Planning

The U.S. tax code is complicated and often hard to understand, with many provisions, credits, and disallowances. Let's review a few credits that many people are interested in, as well as how to respond to the IRS if you get married — or get a taxes-due notice.

Posted in Tax Planning

Advantages of Keeping Your Business Separate From Its Real Estate

Posted by Jessica L. Pagan, CPA on Oct 07, 2024

Does your business require real estate for its operations? Or do you hold property titled under your business’s name? It might be worth reconsidering this strategy. With long-term tax, liability, and estate planning advantages, separating real estate ownership from the business may be a wise choice.

Posted in Business Tax

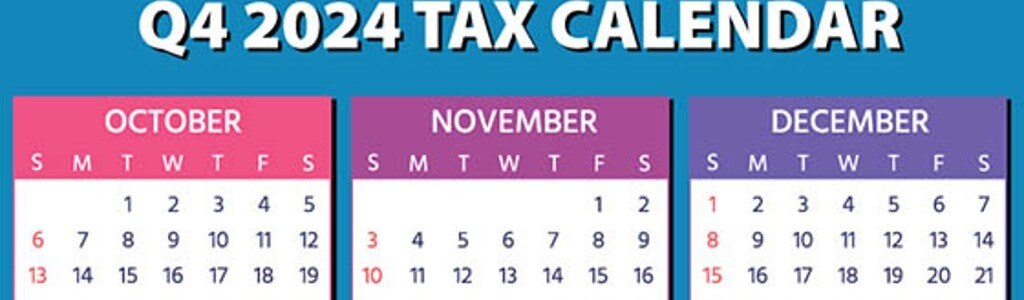

2024 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Sep 25, 2024

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Reasons an LLC Might Be the Ideal Choice for Your Small Business

Posted by Jessica L. Pagan, CPA on Sep 10, 2024

Choosing the right business entity is a key decision for any business. The entity you pick can affect your tax bill, your personal liability, and other issues. For many businesses, a limited liability company (LLC) is an attractive choice. It can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This duality may provide the owners with several benefits.

Posted in Business Advisory