Increase Your Current Business Deductions Under Tangible Property Safe Harbors

Posted by Marty Williams, CPA on Feb 04, 2026

Posted in Taxation

Under U.S. Generally Accepted Accounting Principles (GAAP), property, plant, and equipment (PPE) assets aren’t immediately expensed. Instead, they’re capitalized on your company’s balance sheet and gradually depreciated over their useful lives. While that sounds easy enough, subtle nuances may trip up small businesses. Here are some tips to help get it right.

Posted in Taxation

House GOP Unveils Extensive List of Proposed Tax Changes

Posted by Michael D. Machen, CPA, CVA on Feb 14, 2025

Republicans in the U.S. House of Representatives Budget Committee recently circulated a draft list of policy options, some of which would help pay for the extension of the expiring provisions of the Tax Cuts and Jobs Act of 2017 and set President Donald Trump’s tax policy agenda.

Posted in Taxation

2024 Presidential Election: What's at Stake for the Asset Management Industry

Posted by Marty Williams, CPA on Sep 13, 2024

The 2024 election is likely to profoundly impact tax policy and legislation. Once the dust settles on the results, the incoming president and Congress will have a tall task in 2025, as the expiration of several 2017 Tax Cuts and Jobs Act (TCJA) provisions will loom large, and many other tax policy proposals will be on the table. All of the moving parts have inspired pundits to refer to 2025 as a year we will see the “Super Bowl of Tax”.

Posted in Taxation

A Cost Segregation Study May Cut Taxes and Boost Cash Flow

Posted by Michael D. Machen, CPA, CVA on Dec 08, 2023

Is your business depreciating over 30 years the entire cost of constructing the building that houses your enterprise? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow.

Posted in Taxation

Accounting is a critical element when launching a successful business venture. Unfortunately, it’s also an area where startups tend to make mistakes. Here are some common (and avoidable) errors that entrepreneurs should watch out for.

Posted in Taxation

Most U.S. states require businesses to collect and remit sales and use taxes even if the business has no in-state physical presence, only an economic presence within their state. Remote sellers, licensors of software, and other businesses that provide services or deliver their products to customers from a remote location must comply with state and local taxes.

Posted in Taxation

2022 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 27, 2022

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Taxation

Biden Administration's FY 2023 Budget Plan Calls for Corporate, High-Net-Worth Individuals Tax Hikes

Posted by Jessica L. Pagan, CPA on Apr 21, 2022

The Biden administration’s fiscal year 2023 budget blueprint, released on March 28, consists of a mix of familiar proposals and brand-new initiatives that reflect the President’s policy objectives. The proposals are described in more detail in the General Explanations of the Administration’s Fiscal Year 2023 Revenue Proposals, commonly referred to as the “Green Book,” that was released with the budget, and include the President’s now-familiar calls for increasing the top corporate tax rate to 28% and the top individual rate to 39.6%.

Posted in Tax Updates, Taxation

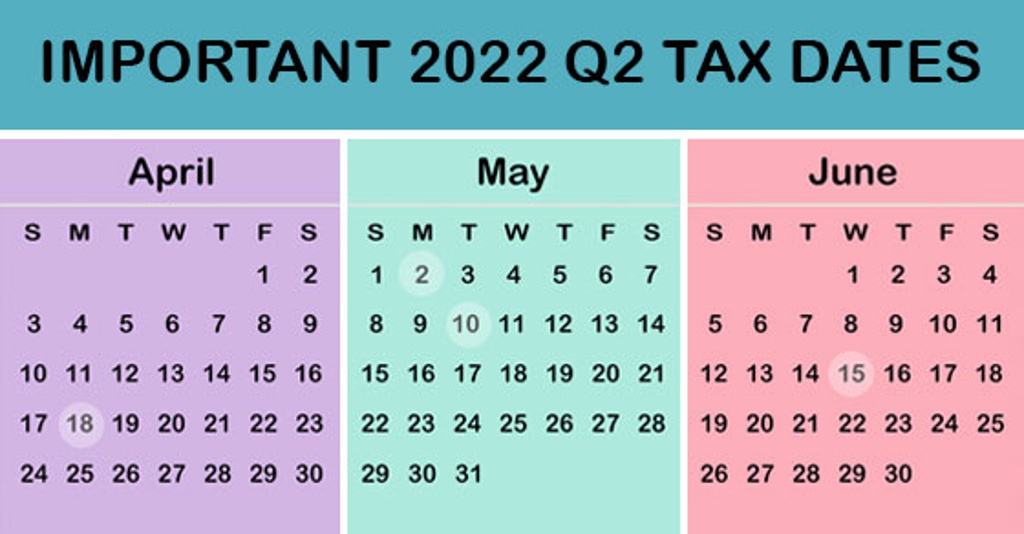

2022 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Apr 08, 2022

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Taxation