Working capital — the funds your company has tied up in accounts receivable, accounts payable, and inventory — is a critical performance metric. During times of rising inflation and interest rates, managers search for ways to free up cash and eliminate waste. However, determining the optimal amount of working capital can sometimes be challenging.

Jessica L. Pagan, CPA

Recent Posts

Take Advantage of the Rehabilitation Tax Credit When Altering or Adding to Business Space

Posted by Jessica L. Pagan, CPA on Apr 19, 2023

If your business occupies substantial space and needs to increase or move from that space in the future, you should keep the rehabilitation tax credit in mind. This is especially true if you favor historic buildings.

Posted in Business Tax

Summer is around the corner, so you may be thinking about hiring young people at your small business. At the same time, you may have children looking to earn extra spending money. You can save family income and payroll taxes by putting your child on the payroll. It’s a win-win!

Posted in Individual Tax

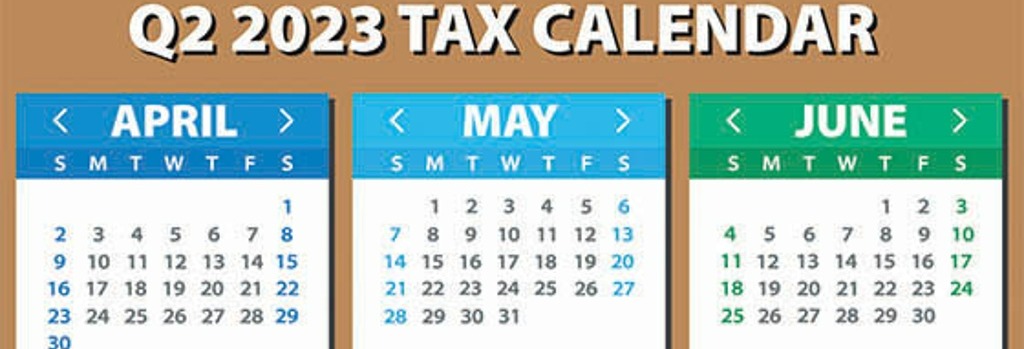

2023 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Mar 21, 2023

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you meet all applicable deadlines and learn more about the filing requirements.

Posted in Business Tax

Protect the "Ordinary and Necessary" Advertising Expenses of Your Business

Posted by Jessica L. Pagan, CPA on Mar 07, 2023

Under tax law, businesses can generally deduct advertising and marketing expenses that help keep existing customers and bring in new ones. This valuable tax deduction can help businesses cut their taxes.

Posted in Business Tax

Inflation Reduction Act: Costs and Benefits for Real Estate & Construction

Posted by Jessica L. Pagan, CPA on Feb 17, 2023

The Inflation Reduction Act's (IRA's) expansion of key energy efficiency tax incentives – such as the 179D energy efficient commercial buildings deduction and the 45L new energy efficient home credit – is anticipated to have a significant impact on real estate and construction industry. The legislation could provide a significant financial boost for firms looking to utilize environmentally conscious building materials and practices, potentially ushering in a new wave of progress in clean energy construction.

Posted in Business Tax

CPA firms do more than audits and tax returns. They can also help you with everyday accounting-related tasks, such as bookkeeping, budgeting, payroll, and sales tax filings. Should your organization outsource its accounting needs? Here are five potential advantages to consider when evaluating this decision.

Posted in Business Advisory

2023 Q1 Tax Calendar: Key Deadlines For Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jan 06, 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.

Posted in Business Tax

Real Estate and Construction Industries' Growing Cybersecurity Threat

Posted by Jessica L. Pagan, CPA on Dec 14, 2022

In the last few years, real estate and construction leaders have made great strides to implement new technologies into their regular practices. While these advances have uncovered additional efficiencies, their adoption has created a critical vulnerability: data security.

Posted in Business Advisory

Does your company use supplier finance programs to buy goods or services? If so, and if you must adhere to U.S. Generally Accepted Accounting Principles (GAAP), there will be changes starting next year. At that time, you must disclose the full terms of supplier finance programs, including assets pledged to secure the transaction. Here are the details of this new requirement under GAAP.

Posted in Business Tax