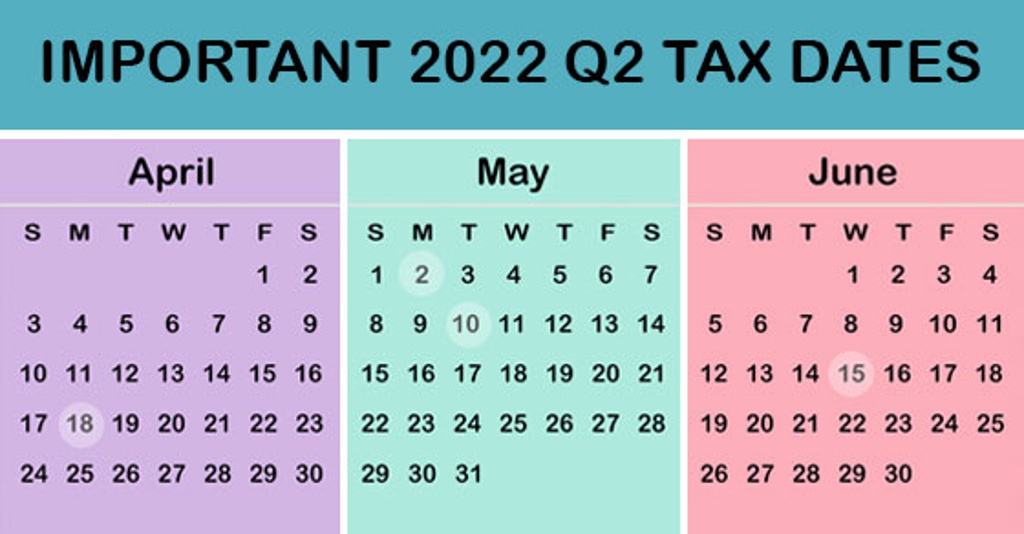

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Jessica L. Pagan, CPA

Recent Posts

2022 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Apr 08, 2022

Posted in Taxation

Significant Change to the Treatment of R&E Expenditure Under Section 174 Now in Effect

Posted by Jessica L. Pagan, CPA on Mar 04, 2022

As 2022 kicks off and tax legislation continues to be stalled in Congress, the amendment to Internal Revenue Code (IRC) Section 174 was originally introduced by the 2017 tax reform legislation, the Tax Cuts and Jobs Act (TCJA), is now in effect.

Posted in Business Tax

Revenue and expenses, as reported on your company’s income statement, have limited usefulness to people inside the organization. Managers often need information presented in a different format in order to make operational and strategic decisions. That’s where activity-based costing comes into play. This costing system is commonly used in the manufacturing and construction sectors to determine which products and customers are profitable, to identify and eliminate waste, and to more accurately price products or bid jobs going forward.

Posted in Accounting & Outsourcing

Entrepreneurs and Taxes: How Expenses Are Claimed on Tax Returns

Posted by Jessica L. Pagan, CPA on Jan 24, 2022

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a business in the midst of a pandemic. For example, they had more time, wanted to take advantage of new opportunities, or they needed money due to being laid off. Whatever the reason, if you’ve recently started a new business or you’re contemplating starting one, be aware of the tax implications.

Posted in Business Tax

Are you thinking about merging with or acquiring a business? CPA-prepared financial statements can provide valuable insight into historical financial results. But an independent quality of earnings (QOE) report can be another valuable tool in the due diligence process. It looks beyond the quantitative information provided by the seller’s financial statements.

Posted in Business Valuation

2021 Year-End Reminders Regarding Common Fringe Benefits, Special Rules for 2% S Corp Shareholders

Posted by Jessica L. Pagan, CPA on Nov 12, 2021

As 2021 draws to a close, employers should review whether they have properly included the value of common fringe benefits in their employees' and (if applicable) 2% S corporation shareholders' taxable wages. This is especially true for 2021 since COVID relief brought about a number of changes to the rules relating to traditional fringe benefits.

Posted in Business Tax

Building Your Tax Department Bench Strength: Benefits of Tax Co-Sourcing

Posted by Jessica L. Pagan, CPA on Oct 22, 2021

Organizations are faced with the challenge to increase operational efficiency while reducing costs and retaining the personnel they need to be strategic. Talent shortages and the resource drain associated with recruiting, onboarding, on-the-job training, and continuing education have many organizations looking for a more efficient and practical approach. Having the flexibility to allocate resources to align with organizational objectives is imperative.

Posted in Accounting & Outsourcing

2021 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers.

Posted by Jessica L. Pagan, CPA on Oct 05, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have a business in federally declared disaster areas.

Posted in Business Tax

Everybody wants to pay as little in taxes as possible. Most people use software or hire an accountant to help them find all the deductions they can subtract from their taxable income and all the credits they can subtract from their final bill. But most tax breaks require you, the taxpayer, to plan ahead. Even the most skilled accountant can't deduct a charity donation from your income if you forgot to save the receipt. Here are some tips from the IRS about year-round tax planning:

Posted in Individual Tax Planning

The Deductibility of Corporate Expenses Covered by Officers or Shareholders

Posted by Jessica L. Pagan, CPA on Aug 03, 2021

Do you play a major role in a closely held corporation and sometimes personally spend money on corporate expenses? These costs may wind up being non-deductible by an officer and the corporation unless proper steps are taken. This issue is more likely to arise in connection with a financially troubled corporation.

Posted in Business Tax