Are you eligible to take the deduction for qualified business income (QBI)? Here are 10 facts about this valuable tax break: the pass-through deduction, QBI deduction, or Section 199A deduction.

Jessica L. Pagan, CPA

Recent Posts

10 Facts About the Pass-Through Deduction for Qualified Business Income

Posted by Jessica L. Pagan, CPA on Jul 07, 2021

Posted in Business Tax

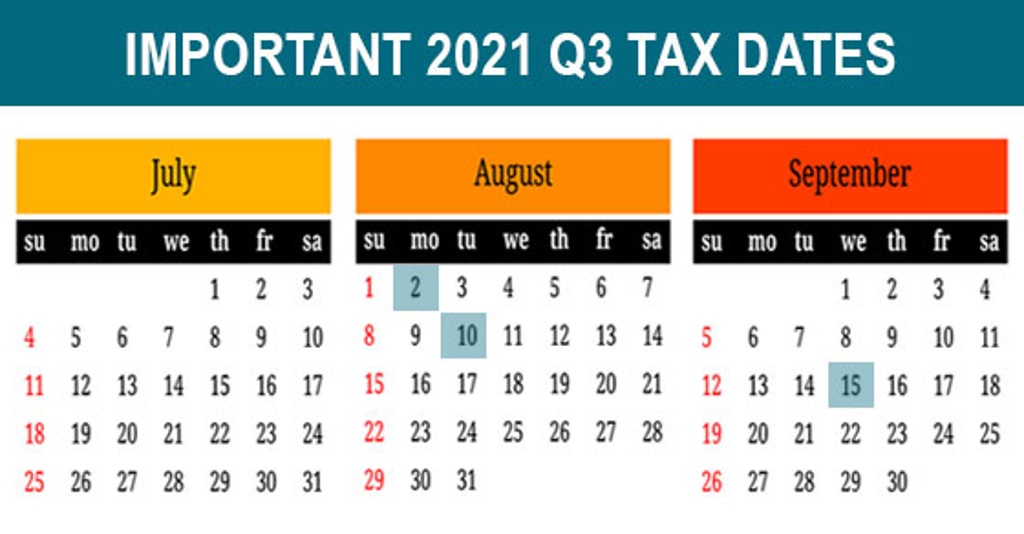

2021 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 15, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Many companies are continuing to struggle financially during the COVID-19 pandemic. If cash is tight, what can your business do to shorten its cash cycle? The answer could lie in your outstanding accounts receivable. Here are five strategies to help convert receivables into cash ASAP.

Posted in Business Advisory

Liabilities for Unused Time off Mount as Pandemic Lingers

Posted by Jessica L. Pagan, CPA on May 07, 2021

Many employees have postponed using their allotted paid time off during the pandemic until COVID-related restrictions are lifted and safety concerns subside. This situation has caused an increase in accruals for certain employers. Here’s some guidance to help evaluate whether your company is required to report a liability for so-called “compensated absences” and, if so, how to estimate the proper amount.

Posted in Business Advisory

Know the Ins and Outs of "Reasonable Compensation" for a Corporate Business Owner

Posted by Jessica L. Pagan, CPA on Apr 22, 2021

Owners of incorporated businesses know that there’s a tax advantage to taking money out of a C corporation as compensation rather than as dividends. The reason: A corporation can deduct the salaries and bonuses that it pays executives, but not dividend payments. Thus, if funds are paid as dividends, they’re taxed twice, once to the corporation and once to the recipient. Money paid out as compensation is only taxed once — to the employee who receives it.

Posted in Business Advisory

The legislation signed in March allows taxpayers who earned less than $150,000 in modified adjusted gross income to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all other eligible taxpayers. The legislation excludes only 2020 unemployment benefits from taxes.

Posted in Individual Tax

The Latest on COVID-Related Deadline Extensions for Health Care Benefits

Posted by Jessica L. Pagan, CPA on Mar 16, 2021

The U.S. Department of Labor (DOL) recently issued EBSA Disaster Relief Notice 2021-01, which is of interest to employers. It clarifies the duration of certain COVID-19-related deadline extensions that apply to health care benefits plans.

Posted in Business Advisory

"No Surprises Act" Protects Patients From Unexpected Medical Costs

Posted by Jessica L. Pagan, CPA on Feb 05, 2021

According to research, millions of Americans receive a surprise medical bill each year, most often as a result of emergency room visits where out-of-network providers perform services at an in-network facility. While the average surprise bill is roughly $600, bills can reach into the tens of thousands. In fact, a COVID-19 patient received a surprise air ambulance bill that was over $52,000.

Posted in Individual Tax

Planning for what lies ahead is an important part of running a healthy business. Forecasting your company’s financial statements can help you manage inventory and other working capital accounts, offer competitive prices, identify impending cash flow shortages and keep your business on solid financial footing.

Posted in Accounting & Outsourcing

2021 Q1 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jan 08, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax