It’s almost time for calendar-year businesses to prepare their year-end financial statements. If used correctly, these reports can be a valuable management tool. Use them in benchmarking and forecasting to be proactive, not reactive, to market changes.

Jessica L. Pagan, CPA

Recent Posts

Put Your Company's Financial Statements to Work for You.

Posted by Jessica L. Pagan, CPA on Dec 17, 2020

Posted in Business Valuation

The Importance of S Corporation Basis and Distribution Elections

Posted by Jessica L. Pagan, CPA on Dec 04, 2020

S corporations can provide tax advantages over C corporations in the right circumstances. This is true if you expect that the business will incur losses in its early years because shareholders in a C corporation generally get no tax benefit from such losses. Conversely, as an S corporation shareholder, you can deduct your percentage share of these losses on your personal tax return to the extent of your basis in the stock and any loans you personally make to the entity.

Posted in Business Tax

Tax Responsibilities if Your Business Is Closing Amid the Pandemic

Posted by Jessica L. Pagan, CPA on Nov 03, 2020

Unfortunately, the COVID-19 pandemic has forced many businesses to shut down. If this is your situation, we’re here to assist you in any way we can, including taking care of the various tax obligations that must be met.

The Tax Rules for Deducting the Computer Software Costs of Your Business

Posted by Jessica L. Pagan, CPA on Oct 14, 2020

Do you buy or lease computer software to use in your business? Do you develop computer software for use in your business or for sale or lease to others? Then you should be aware of the complex rules that apply to determine the tax treatment of the expenses of buying, leasing, or developing computer software.

Posted in Business Tax

The Easiest Way to Survive an IRS Audit Is to Get Ready In Advance.

Posted by Jessica L. Pagan, CPA on Oct 07, 2020

IRS audit rates are historically low, according to the latest data, but that’s little consolation if your return is among those selected to be examined. But with proper preparation and planning, you should fare well.

Posted in Business Tax

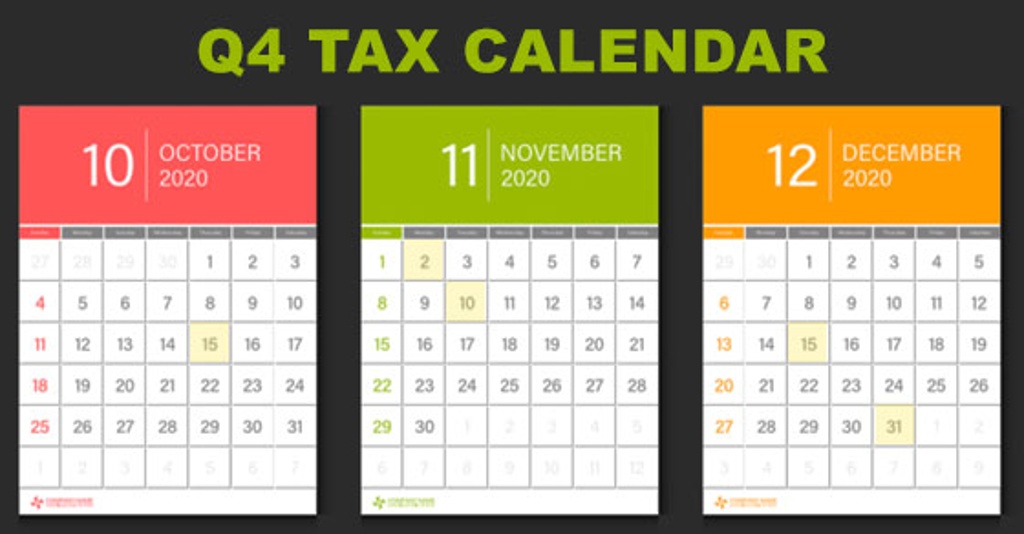

2020 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Sep 17, 2020

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

You're probably aware of the 100% bonus depreciation tax break that's available for a wide range of qualifying property. Here are five important points to be aware of when it comes to this powerful tax-saving tool.

Posted in Business Tax

If your business was fortunate enough to get a Paycheck Protection Program (PPP) loan taken out in connection with the COVID-19 crisis, you should be aware of the potential tax implications.

Posted in Business Advisory

Timely, relevant financial data is critical to managing a business in today’s unprecedented conditions. Similar to the control panel in a vehicle or machine, dashboard reports provide a real-time snapshot of how your business is performing.

Posted in Business Advisory

Launching a Business? How to Treat Start-up Expenses on Your Tax Return

Posted by Jessica L. Pagan, CPA on Jun 23, 2020

While the COVID-19 crisis has devastated many existing businesses, the pandemic has also created opportunities for entrepreneurs to launch new businesses. For example, some businesses are being launched online to provide products and services to people staying at home.

Posted in Business Tax