If you’re a partner in a business, you may have come across a situation that gave you pause. In a given year, you may be taxed on more partnership income than was distributed to you from the partnership in which you’re a partner.

Nick Wheeler, CPA

Recent Posts

Why Do Partners Sometimes Report More Income on Tax Returns Than They Receive in Cash?

Posted by Nick Wheeler, CPA on Aug 03, 2020

Posted in Business Tax

Paycheck Protection Program Loan and Forgiveness Best Practices

Posted by Nick Wheeler, CPA on Jun 03, 2020

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on March 27, 2020, and authorized more than $2 Trillion in aid to battle COVID-19 and the economic effects it was having on the U.S. This provided for immediate cash payments to individual citizens, loan programs for small businesses, support for the medical industry and providers directly impacted, and various other economic relief packages for impacted businesses.

Posted in Accounting & Outsourcing

Government Assistance Programs: Are You Ready for Scrutiny?

Posted by Nick Wheeler, CPA on May 14, 2020

Organizations of all shapes and sizes have sought to take advantage of government assistance and programs to help their business persevere and maintain operations during the COVID-19 pandemic.

Posted in Accounting & Outsourcing

Relief From Not Making Employment Tax Deposits Due to COVID-19 Tax Credits

Posted by Nick Wheeler, CPA on Apr 13, 2020

The IRS has issued guidance providing relief from failure to make employment tax deposits for employers that are entitled to the refundable tax credits provided under two laws passed in response to the coronavirus (COVID-19) pandemic. The two laws are the Families First Coronavirus Response Act, which was signed on March 18, 2020, and the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act, which was signed on March 27, 2020.

Posted in Business Tax

Businesses across the country are being affected by the coronavirus (COVID-19). Fortunately, Congress recently passed a law that provides at least some relief. In a separate development, the IRS has issued guidance allowing taxpayers to defer any amount of federal income tax payments due on April 15, 2020, until July 15, 2020, without penalties or interest.

Posted in Business Tax

Roughly half of CFOs believe an economic recession will hit by the end of 2020, and about three-quarters expect a recession by mid-2021, according to the 2019 year-end Duke University/CFO Global Business Outlook survey. In light of these bearish predictions, many businesses are currently planning for the next recession. Are you? Here are four steps to help your company strengthen its balance sheet against a possible downturn.

Posted in Accounting & Outsourcing

Construction contractors, professional service firms, specialty manufacturers and other companies that work on large projects often struggle with job costing. Full cost allocations are essential to gauging whether you’re making money on each job. But some companies simply lump indirect job costs into overhead or fail to use meaningful cost drivers, thereby skewing their profit reports. Here’s what you should know to avoid this pitfall and get a clearer picture of your company’s profitability.

Posted in Business Tax

Holiday Parties and Gifts Can Help Show Your Appreciation and Provide Tax Breaks

Posted by Nick Wheeler, CPA on Dec 10, 2019

With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good idea to understand the tax rules associated with these expenses. Are they tax deductible by your business and is the value taxable to the recipients?

Posted in Business Tax

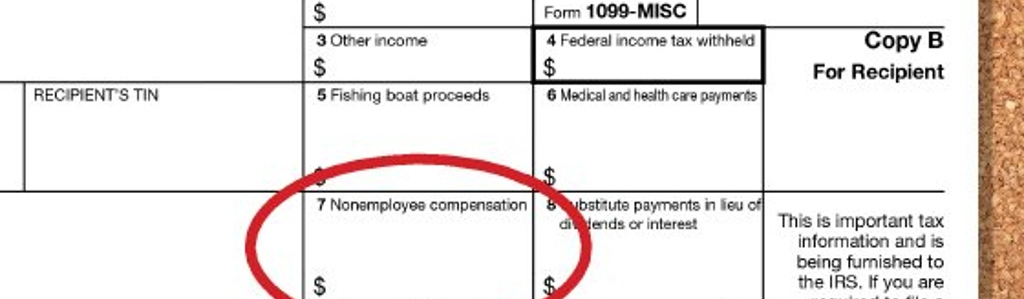

Small Businesses: Get Ready for Your 1099-MISC Reporting Requirements

Posted by Nick Wheeler, CPA on Nov 13, 2019

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors, and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time-consuming and there are penalties for not complying, so it’s a good idea to begin gathering information early to help ensure smooth filing.

Posted in Accounting & Outsourcing

How to Treat Your Business Website Costs for Tax Purposes

Posted by Nick Wheeler, CPA on Oct 17, 2019

These days, most businesses need a website to remain competitive. It’s an easy decision to set one up and maintain it. But determining the proper tax treatment for the costs involved in developing a website isn’t so easy.

Posted in Business Tax