“When should I begin to collect Social Security benefits?”

It’s a question we hear often—and that’s understandable. People who are nearing the retirement age face this very difficult decision, and the actions they take can have profound implications.

When it comes to deciding when to begin collecting Social Security benefits, there are so many variables that factor into the decision—and so many possible questions about the timing implications. Too often, the decision that individuals make is unnecessarily delayed—or it’s made without forethought or planning.

For people who are nearing retirement age (which is as young as 62 for early retirement), it is extremely wise to begin educating themselves on the process of claiming benefits, and the variables that can affect their decision. Armed with that knowledge, they can make informed decisions about how and when to claim benefits in ways that are the most advantageous to them.

Taking Control of Your Situation

It is crucially important to review your financial situation before claiming benefits. In that regard, consider the following:

- How much the reduced benefit from early filing might cost you after considering the Delayed Retirement Credits

- The impact of delaying benefits beyond full retirement age on survivor benefits

- How Social Security benefits will be taxed—particularly if you have assets in qualified retirement plans

If this seems complicated, know that planning for spousal benefits is even more so. When planning for spousal benefits, you should take into account worker benefits, spousal benefits and survivor benefits.

Since you or your spouse will now be covered under Medicare, it is also wise to have a professional review your Medicare benefits options during open enrollment, as there are many choices to make, and each one can have a financial impact.

Planning Appropriately to Maximize Benefits

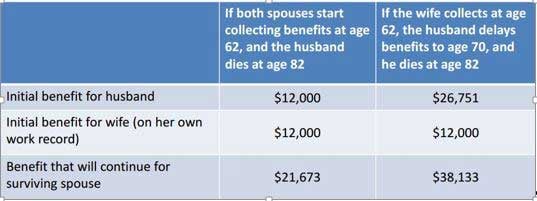

Proper Social Security planning can have a dramatic impact on benefits. For example, consider how delaying Social Security can benefit a surviving spouse:

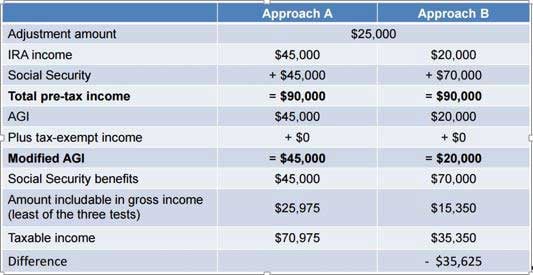

Additionally, income taxes can be minimized. Consider the following example:

Using one approach, you would take reduced Social Security payments early and supplement those with higher IRA withdrawals. With an alternate approach, you would simply delay your Social Security payment.

Planning and Strategy Pay Off in the Long Run

As you can see, understanding the variables that factor into the decision about when to begin collecting Social Security benefits, and making sensible decisions based on your specific circumstances, can be enormously advantageous to you and your loved ones.

If you have any questions about Social Security benefits or individual services, please contact Trisha Williams., CPA at (334) 887-7022 or please feel free to leave us a message below.