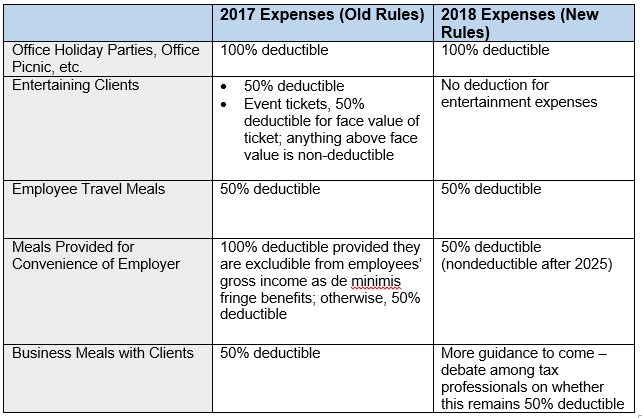

Understanding the implications of the Tax Reform Act will be critical in business planning for 2018. The Act placed stricter limits on what businesses can deduct for meals and entertainment and suspended the exclusion of moving expenses from an employee’s income. Please see the tables below comparing the rules before and after the Act.

Understanding the implications of the Tax Reform Act will be critical in business planning for 2018. The Act placed stricter limits on what businesses can deduct for meals and entertainment and suspended the exclusion of moving expenses from an employee’s income. Please see the tables below comparing the rules before and after the Act.

Meals and Entertainment

To maximize tax deductions and save time on tax preparation of your 2018 tax returns, Machen McChesney recommends updating your general ledger with separate accounts for business meals (50 percent deduction may be possible), entertainment (nondeductible) and recreational/social employee expenses (100 percent deductible).

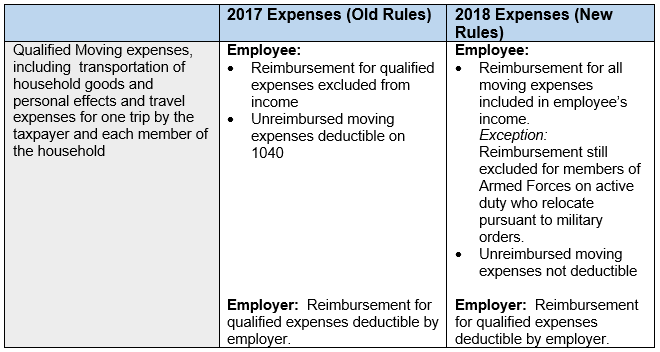

Qualified Moving Expenses

For more information about the above information or other business tax services, please contact Lesley L. Price, CPA at (334) 887-7022 or by leaving us a message below.