If you operate a small business, or you’re starting a new one, you probably know you need to keep records of your income and expenses. In particular, you should carefully record your expenses in order to claim the full amount of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns if you’re ever audited by the IRS or state tax agencies.

Good Records Are the Key to Tax Deductions and Trouble-free IRS Audits

Posted by Lisa Albritton on Jun 15, 2020

Posted in Accounting & Outsourcing

Many companies struggle to close the books at the end of the month. The month-end close requires accounting personnel to round up data from across the organization. Under normal conditions, this process can strain internal resources.

Posted in Accounting & Outsourcing

Paycheck Protection Program Loan and Forgiveness Best Practices

Posted by Nick Wheeler, CPA on Jun 03, 2020

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on March 27, 2020, and authorized more than $2 Trillion in aid to battle COVID-19 and the economic effects it was having on the U.S. This provided for immediate cash payments to individual citizens, loan programs for small businesses, support for the medical industry and providers directly impacted, and various other economic relief packages for impacted businesses.

Posted in Accounting & Outsourcing

Government Assistance Programs: Are You Ready for Scrutiny?

Posted by Nick Wheeler, CPA on May 14, 2020

Organizations of all shapes and sizes have sought to take advantage of government assistance and programs to help their business persevere and maintain operations during the COVID-19 pandemic.

Posted in Accounting & Outsourcing

Hiring Independent Contractors? Make Sure They're Properly Classified

Posted by Murry Guy, CPA on May 04, 2020

As a result of the coronavirus (COVID-19) crisis, your business may be using independent contractors to keep costs low. But you should be careful that these workers are properly classified for federal tax purposes. If the IRS reclassifies them as employees, it can be an expensive mistake.

Posted in Accounting & Outsourcing

Answers to Questions About the CARES Act Employee Retention Tax Credit

Posted by Murry Guy, CPA on Apr 06, 2020

The recently enacted Coronavirus Aid, Relief, and Economic Security (CARES) Act provides a refundable payroll tax credit for 50% of wages paid by eligible employers to certain employees during the COVID-19 pandemic. The employee retention credit is available to employers, including nonprofit organizations, with operations that have been fully or partially suspended as a result of a government order limiting commerce, travel or group meetings.

Posted in Accounting & Outsourcing

Accounts receivables are classified under current assets on the balance sheet if you expect to collect them within a year or within the operating cycle, whichever is longer. However, unless your company sells goods or services exclusively for cash, some of its receivables inevitably will be uncollectible. That’s why it’s important to record an allowance for doubtful accounts (also known as “bad debts”). These allowances are subjective, especially in uncertain economic times.

Posted in Accounting & Outsourcing

Roughly half of CFOs believe an economic recession will hit by the end of 2020, and about three-quarters expect a recession by mid-2021, according to the 2019 year-end Duke University/CFO Global Business Outlook survey. In light of these bearish predictions, many businesses are currently planning for the next recession. Are you? Here are four steps to help your company strengthen its balance sheet against a possible downturn.

Posted in Accounting & Outsourcing

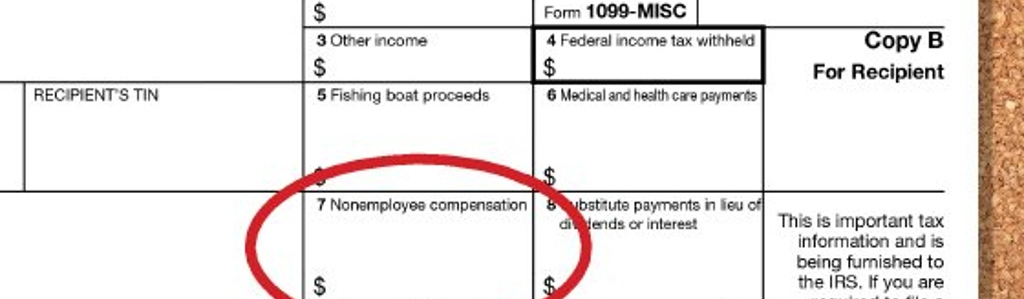

Small Businesses: Get Ready for Your 1099-MISC Reporting Requirements

Posted by Nick Wheeler, CPA on Nov 13, 2019

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors, and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time-consuming and there are penalties for not complying, so it’s a good idea to begin gathering information early to help ensure smooth filing.

Posted in Accounting & Outsourcing

Small Businesses: Stay Clear of a Severe Payroll Tax Penalty

Posted by Murry Guy, CPA on Nov 05, 2019

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time.

Posted in Accounting & Outsourcing