IRS audit rates are historically low, according to the latest data, but that’s little consolation if your return is among those selected to be examined. But with proper preparation and planning, you should fare well.

The Easiest Way to Survive an IRS Audit Is to Get Ready In Advance.

Posted by Jessica L. Pagan, CPA on Oct 07, 2020

Posted in Business Tax

Business Website Costs: How to Handle Them for Tax Purposes

Posted by Lesley L. Price, CPA on Sep 22, 2020

The business use of websites is widespread. But surprisingly, the IRS hasn’t yet issued formal guidance on when Internet website costs can be deducted.

Posted in Business Tax

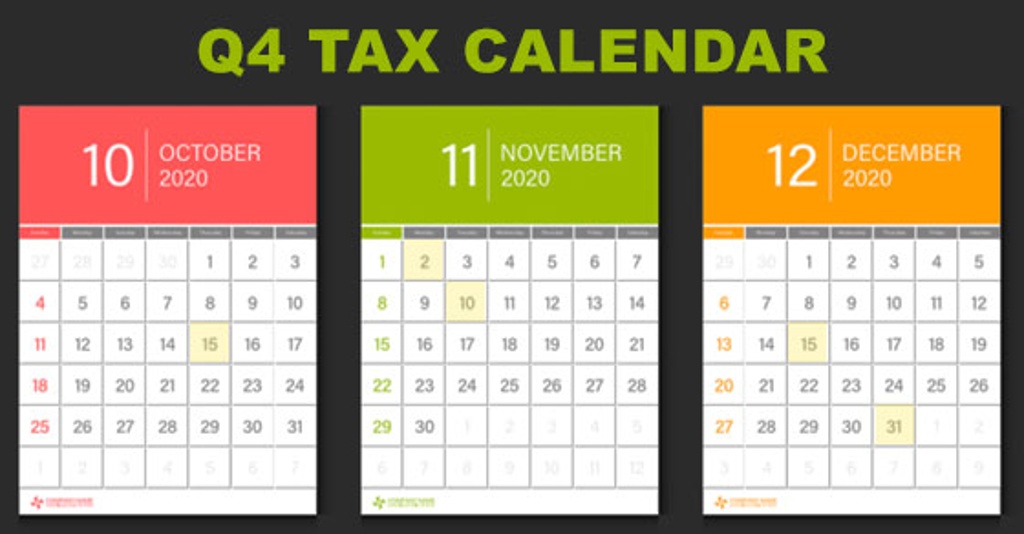

2020 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Sep 17, 2020

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

You're probably aware of the 100% bonus depreciation tax break that's available for a wide range of qualifying property. Here are five important points to be aware of when it comes to this powerful tax-saving tool.

Posted in Business Tax

The Coronavirus Aid, Relief, and Economic Security (CARES) Act made changes to excess business losses. This includes some changes that are retroactive, and there may be opportunities for some businesses to file amended tax returns.

Posted in Business Tax

File Cash Transaction Reports for Your Business — On Paper or Electronically

Posted by Lesley L. Price, CPA on Aug 05, 2020

Does your business receive large amounts of cash or cash equivalents? You may be required to submit forms to the IRS to report these transactions.

Posted in Business Tax

Why Do Partners Sometimes Report More Income on Tax Returns Than They Receive in Cash?

Posted by Nick Wheeler, CPA on Aug 03, 2020

If you’re a partner in a business, you may have come across a situation that gave you pause. In a given year, you may be taxed on more partnership income than was distributed to you from the partnership in which you’re a partner.

Posted in Business Tax

Even If No Money Changes Hands, Bartering Is a Taxable Transaction.

Posted by Lesley L. Price, CPA on Jul 28, 2020

During the COVID-19 pandemic, many small businesses are strapped for cash. They may find it beneficial to barter for goods and services instead of paying cash for them. If your business gets involved in bartering, remember that the fair market value of goods that you receive in bartering is taxable income. And if you exchange services with another business, the transaction results in taxable income for both parties.

Posted in Business Tax

Launching a Business? How to Treat Start-up Expenses on Your Tax Return

Posted by Jessica L. Pagan, CPA on Jun 23, 2020

While the COVID-19 crisis has devastated many existing businesses, the pandemic has also created opportunities for entrepreneurs to launch new businesses. For example, some businesses are being launched online to provide products and services to people staying at home.

Posted in Business Tax

The Coronavirus Aid, Relief, and Economic Security (CARES) Act eliminates some of the tax-revenue-generating provisions included in a previous tax law. Here’s a look at how the rules for claiming certain tax losses have been modified to provide businesses with relief from the novel coronavirus (COVID-19) crisis.

Posted in Business Tax