Healthcare Has a Margin Erosion Problem

Healthcare Has a Margin Erosion Problem

The past few years have significantly destabilized the healthcare industry’s financial footing. According to our 2023 Healthcare CFO Outlook Survey, 60% of healthcare CFOs could not meet the terms of their bond or loan covenants in 2022 — up from 41% in 2021.

As unfavorable economic conditions continue to pressure healthcare, providers must act to prevent further margin erosion and financial insecurity. Unfortunately, many providers are struggling with margin erosion dynamics that show no signs of resolving on their own. According to Fitch Ratings, it may take years for healthcare margins to recover to pre-pandemic levels.

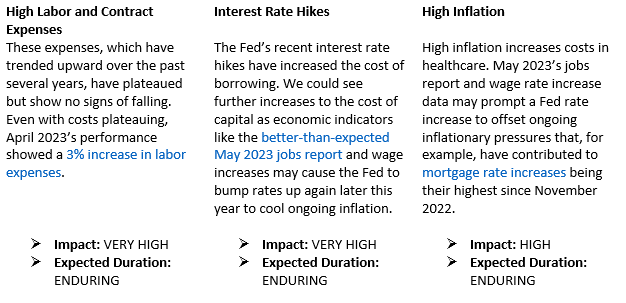

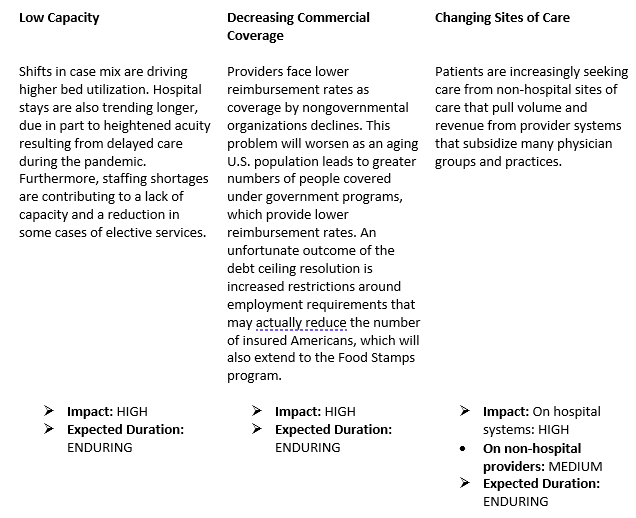

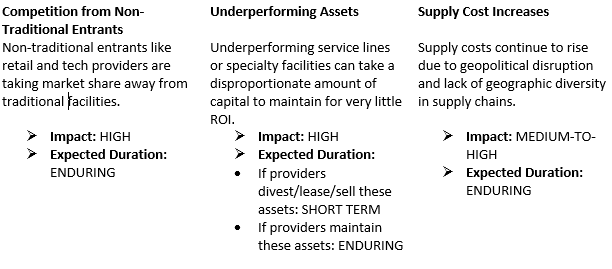

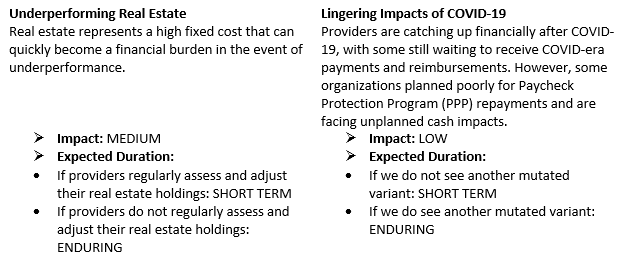

To improve margins and achieve greater financial stability, healthcare providers must first understand what’s causing margin erosion. The following sections outline key drivers of margin erosion, their impact on the healthcare industry, and their expected duration.

What You Can Do About Margin Erosion

Many providers are tempted to solve margin erosion by cutting costs. Margin improvement, however, requires a long-term strategy, and cost-cutting without a growth strategy is a shortsighted approach. While it may generate some immediate bottom-line improvement, it’s unlikely to strengthen your financial foundation. On the other hand, developing a margin improvement strategy allows providers to gradually make structural changes that yield long-term results — and greater stability.

Need to establish a margin improvement strategy, but not sure where to start? Our checklist below outlines the information you need and recommended steps you should take to develop your strategy.

Phase 1

Identifying Cost and Revenue Opportunities

- Benchmark your costs in the following areas against industry standards:

- Provider and clinical support staffing

- Pharmacy

- Perioperative and procedural

- Supply chain

- Vendor management

- Selling, general & administrative (SG&A)

- IT

- Assess your revenue cycle management to identify gaps and inefficiencies.

- Review your patient access, demand, and capacity management to identify gaps and inefficiencies.

- Assess the profitability of each of your service lines.

Phase 2

Reviewing Balance Sheets

- Identify your priority strategic initiatives and determine the capital requirements to support them.

- Conduct a property, plant, and equipment (PP&E) assessment to determine if any assets should be sold, leased, or disposed of.

- Identify opportunities to deploy or reinvest working capital.

- Reevaluate your debt structure to assess your organization’s current financial risk level.

- Determine whether you have any unclaimed property and, if so, review your state’s regulations around reporting and refunds ahead of balance sheet transactions.

- Assess your management of assets like technical systems and medical equipment to identify gaps and inefficiencies.

- Identify opportunities to capitalize on R&D tax credits.

Phase 3

Accelerating Digital Enablement

- Explore opportunities to leverage data and machine learning to reduce preventable readmissions.

- Offer expanded consumer-centric self-service tools with a side benefit of shifting work into the hands of patients.

- Assess your EHR platform to determine if it is properly integrated with your other systems and can support data-driven predictions.

- Prior to introducing new technology systems, evaluate their potential impact on and disruption to clinicians and administrative staff.

Phase 4

Exploring Partnership Opportunities

- Consider opportunities to partner and collaborate for functions such as I.T., contact centers, and supply chains.

- Explore outsourcing and managed service arrangements to achieve efficiencies in core business operations.

- Critically evaluate mergers and integration opportunities to ensure they are patient-centric and focus on improving care at lower costs.

Phase 5

Developing Your Workforce

- Consider how you can enable remote work opportunities to expand your talent pool.

- Invest in continuous learning to promote employee retention and satisfaction.

- Integrate advanced practice providers (APPs) across service lines.

- Invest in recruiting and training licensed practical nurses (LPNs) and medical assistants (M.A.s).

For more information about the above article or other business advisory services, contact Marty Williams, CPA, at (334) 887-7022 or by leaving us a message below.

Written by David Francis and Jim Clayton. Copyright © 2023 BDO USA, LLP. All rights reserved. www.bdo.com