What a difference a year makes. In 2021, cryptocurrency markets reached all-time highs. Broader institutional adoption continued with the likes of BlackRock, Fidelity, JPMorgan Chase, Morgan Stanley, Deutsche Bank, and Goldman Sachs investing in the space and offering their clients crypto assets. Interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) was at an all-time high.

What a difference a year makes. In 2021, cryptocurrency markets reached all-time highs. Broader institutional adoption continued with the likes of BlackRock, Fidelity, JPMorgan Chase, Morgan Stanley, Deutsche Bank, and Goldman Sachs investing in the space and offering their clients crypto assets. Interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) was at an all-time high.

In 2022, new challenges arose that were both industry specific and wider macroeconomic. Geopolitical tensions and macroeconomic headwinds increased. Although the Federal Reserve raised interest rates multiple times, the rate of inflation remains high and recessionary pressures persist. While crypto valuations declined markedly, that market correction is in line with the trajectory of other higher-risk asset classes. Specific to the crypto industry, the failures of the Terra Luna ecosystem and most recently the downfall of FTX are going to have wide-reaching implications throughout the industry and highlights the need for better guidance and regulation from lawmakers.

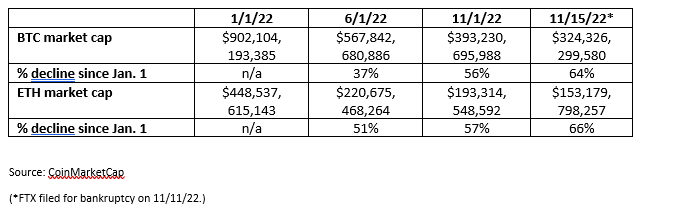

The overall market capitalization for the two largest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), has fallen substantially since January. The below chart summarizes percentage declines for each at the start of 2022, mid-year, start of November and mid-November following FTX’s bankruptcy filing.

Looking ahead, three notable developments in 2022 have significant implications for crypto markets: the Ethereum Merge, lessons learned from Terra Luna and the continued evolution of DeFi and stablecoins, and the fall of FTX and the regulatory and legislative changes which may emerge as a result.

Ethereum Merge (the “Merge”)

The culmination of a multi-year process to shift from an energy-intensive, proof-of-work blockchain to a separate proof-of-stake blockchain occurred on September 15, 2022. Despite some concerns that the Merge could cause network disruption and negatively impact value, it was executed without any major issues. It represents one of the most significant blockchain developments and has major implications for the future of blockchain and crypto.

Electricity usage related to crypto mining has come under scrutiny in recent years. Compared to a proof-of-stake model, proof-of-work consensus miners consume much more energy as they compete to verify the accuracy of new transactions by completing a complex computational puzzle.

In contrast, the proof-of-stake blockchain is a mechanism to achieve distributed consensus by selecting validators randomly based on the number of coins they have staked in the blockchain network via smart contracts. In addition to proof-of-stake using less energy than proof-of-work, it can also enable faster transactions due to higher throughput and allow for greater capacity.

Crypto Energy Consumption

By some estimates, one bitcoin transaction uses the same amount of power that the average U.S. household consumes in about 50 days. And the annual power consumption is comparable to that of some large countries such as Argentina or Pakistan — although estimates vary greatly based upon source and use rates change year to year.

As of early November 2022, the Cambridge Bitcoin Energy Consumption Index estimated Bitcoin’s annualized energy consumption at approximately 101 terawatt-hours (TWh). Overall, Bitcoin accounts for less than 0.2% of global energy use, and its energy mix is significantly less carbon intensive than many other industries or activities.

Nevertheless, with companies and stakeholders placing a greater focus on sustainability, carbon emissions and environmental risk factors, there is good reason to seek a more energy-efficient system for crypto mining. The proof-of-stake blockchain is a key element for achieving that.

Through various Ethereum Improvement Proposals that enhance the network, ETH can also become a deflationary asset as usage increases. This would happen when the daily burn rate — the number of tokens removed from circulation — exceeds the number of tokens being generated.

Regarding what’s next for ETH, the Merge is part of a multi-phase process. The Ethereum Foundation targets 2023 for what it calls the Surge, which involves processes to improve scalability and reduce congestion on the network by creating new chains, known as “shards,” to help boost capacity for transactions per second. Subsequent phases will seek to optimize data storage (“Verge”), remove unnecessary historical data to reduce network congestion (“Purge”) and make additional enhancements to blockchain design and block production (“Splurge”).

Overall, the Merge and shift to proof-of-stake marks one of the most significant developments in the history of crypto and blockchain.

What happened with Terra Luna and FTX?

As crypto grew to new heights in 2021, DeFi was one focus area that held great promise for the future of crypto and decentralized blockchain protocols. However, 2022 brought significant new challenges for DeFi amid mismanagement and the failures of multiple centralized companies and platforms. Those stumbles also increased scrutiny from regulators and legislators.

Terra Stablecoin and Other Notable Setbacks

Terra Luna was a project involving the dual-token system that used the Terra blockchain for an algorithmic stablecoin alongside the Luna collateral coin. Many investors were drawn by the Anchor lending protocol that paid yields near 20% from Terra reserves. At one point, Luna was among the 10 most valuable cryptocurrencies. Unfortunately, the TerraUSD stablecoin was pegged to the value of the U.S. dollar via an algorithm. When the dollar peg broke in May 2022, Terra and Luna both collapsed in value. As a result, investors lost over $40 billion.

Additional high-profile setbacks included the following:

- July 2022: Bankruptcy declaration by crypto lending company Celsius Network.

- June 2022: Liquidation of crypto hedge fund Three Arrows Capital following a margin call by crypto broker Voyager Digital, which also declared bankruptcy.

- February 2022: SEC settlement by crypto lending platform BlockFi to pay $100 million in penalties for failing to register its retail lending product.

DeFi and the perils of centralization

A key takeaway from some of these recent challenges is that the underlying DeFi blockchain protocols did not cause these incidents, and they actually performed as designed. However, the threat of improper risk management and lack of transparency by centralized companies in the crypto space is a key risk, just like with any traditional centralized company. Some of the products involved, including algorithmic stablecoins, entail complexity that demands further research and transparency.

In the wake of the above incidents, regulators and legislators have increasingly emphasized the need to protect investors and limit potential risk. As of September 2022, a draft bill in the House of Representatives could potentially implement a two-year ban on algorithmic (or “endogenously collateralized”) stablecoins and dollar-pegged digital assets like TerraUSD.

DeFi still holds significant importance for future projects as well. Once a smart contract is established, the parties cannot withdraw or modify the terms. DeFi can also enable full transparency for blockchain activity, in contrast to limited information about the financial health of private companies and potential for over-collateralization. Mismanagement and malfeasance can pose risks with any company that lacks adequate governance and risk management, but transparency and decentralization can help limit those risks considerably.

The Sudden Collapse of FTX

The most significant crypto development still fresh in everyone’s minds is the collapse of crypto exchange FTX in November 2022 and the resignation of CEO Sam Bankman-Fried (“SBF”). This was a firm that had raised hundreds of millions of dollars from top venture capital firms, had deals with celebrities, sports arenas and large corporations, and was ran by a man who was coined as the JP Morgan of crypto.

Ironically, SBF spent a lot of time pushing for more regulation in crypto. So how did one of the largest exchanges in the world go bust so quickly? While the story continues to develop each day, allegedly FTX had lent customer funds to a related party affiliate, Alameda Research, which then invested those funds. A run of withdrawals on FTX — prompted in part by rival Binance selling its holdings of FTT, FTX’s native exchange token — caused a major liquidity issue where FXT suspended withdrawals. FTX subsequently announced it would be acquired by Binance, but Binance backed out of the rescue deal a day later, leading to FTX’s bankruptcy filing and widespread fallout for investors.

Bankman-Fried told The New York Times that the affiliated trading firm, Alameda Research, had a large “margin position” on FTX which resulted in the multibillion-dollar shortfall in user funds. FTX confirmed in a bankruptcy filing that it is in contact with “dozens of federal, state and international regulatory agencies” and “there could be more than one million creditors.” In addition to scrutiny from the SEC and U.S. Department of Justice, Bahamian authorities announced that regulators suspended FTX’s registration and law enforcement is investigating potential criminal misconduct. A class action lawsuit seeking damages has also been filed against Bankman-Fried and various celebrity endorsers who promoted the platform.

The stunning collapse of an industry-leading exchange highlighted the importance of several important themes highlighted by FTX’s newly appointed CEO John Ray III, who also served as the CEO of Enron after its implosion. The picture Mr. Ray paints is not pretty, highlighting a “complete failure of corporate controls” and “a complete absence of trustworthy financial information”. Regardless of whether a firm is in crypto or a more traditional industry, the failure of FTX serves to remind us of the importance of:

- Having a reputable and experienced audit firm

- Timely U.S. GAAP or IFRS compliant audits

- Frequent proof of reserve audits

- Experienced management team and board of director involvement driving key internal control cycles

- Transparency and disclosure around related party transactions

Heightened Regulatory and Legislative Scrutiny

Regulatory Developments

While there has been a history of industry participants asking lawmakers for increased guidance and clarity in the space, questions remain about how to classify specific digital assets and whether regulatory authority should sit with the SEC, Commodity Futures Trading Commission (CFTC) or perhaps a dedicated federal agency. The most recent situation with FTX highlights the need for lawmakers to place more priority in providing guidance to industry participants and striking the proper balance of protecting investors and consumers and supporting innovation and entrepreneurism to. With no regulation, the probability of inexperienced companies losing investor / consumer funds increases. If U.S. regulatory oversight becomes too strict, entrepreneurs could also decide to build and invest in operations based in more conducive jurisdictions abroad. Due to the global nature of digital assets, there could also be the possibility that some form of transnational oversight is created.

There have been several recent regulatory developments, and other enforcements and lawsuits are in progress. The SEC has created an internal resource known as the Strategic Hub for Innovation and Financial Technology (FinHub), which helps coordinate on financial innovation issues. FinHub also issued a framework for analysis that includes 38 considerations, stemming in part from the 1946 Supreme Court decision in SEC v. W. J. Howey Co. That case led to the so-called Howey test for determining if an investment contract exists. The four elements to review are whether there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.” The FinHub framework can also help market participants determine whether a specific digital asset is classified as a security.

One notable case is the SEC's lawsuit against Ripple Labs in the Southern District of New York — ongoing as of October 2022. Each side has filed a motion for summary judgement. The case highlights that clearer guidance is needed on what is considered a security in relation to tokens. At issue is whether a draft of a 2018 speech by the then-director of the SEC Division of Corporate Finance included the director’s personal statements or official SEC guidance. Ripple claims its founder interpreted that draft speech to mean the XRP token was not considered an investment contract or security by the SEC, so it did not need a prospectus. The case’s outcome could set an important legal precedent for other companies.

Another notable enforcement action is the sanction of virtual currency mixer Tornado Cash by the Treasury Department’s Office of Foreign Assets Control (OFAC) in August 2022. OFAC placed the company on its Specially Designated Nationals list, which prohibits Americans from using the service and could lead to criminal penalties.

And in July 2022, the SEC charged a former Coinbase product manager and two others with insider trading related to cryptocurrencies eventually listed on the Coinbase platform. The complaint alleges they purchased over two dozen crypto assets and designates nine of those as securities.

Each of these developments signals that U.S. regulators are giving close attention to crypto assets and related companies. As the regulatory regime evolves, it will be important to monitor new developments and ensure compliance with all applicable requirements.

Legislative Developments

There have been multiple notable legislative developments related to digital assets as well. The bipartisan Responsible Financial Innovation Act from U.S. Senators Cynthia Lummis and Kirsten Gillibrand was proposed in 2022. It takes a comprehensive approach and addresses multiple areas, including stablecoin regulation, tax status of digital assets, interagency coordination and specific industry guidelines. That bill would potentially give the CFTC direct authority over digital assets due to their status being more like commodities than securities, which differs from the SEC’s stance on some digital assets.

Similarly, a bipartisan House bill, the Digital Commodity Exchange Act of 2022, would more clearly define a “digital commodity” and grant the CFTC wider oversight of crypto spot markets and companies that issue or facilitate trading of applicable tokens. Overall, the House bill is narrower in scope than the proposed Senate bill.

Ultimately, thoughtful legislation and regulation over crypto is necessary to prevent fraud, encourage transparency and protect investors. Such regulation can assist in crypto’s broader growth and adoption. However, improving regulation will take time and require input from a range of stakeholders.

What to Watch in 2023

Crypto companies and investors remain concerned about whether there will be greater clarity on industry regulation and complex taxation issues. Additional guidance is needed, including the distinction between whether specific tokens are considered a commodity or a security and which agency has oversight responsibilities. As DeFi evolves, there remains considerable uncertainty over what the landscape will look like in the months and years ahead. Lawmakers will also need to provide more guidance to custodians / exchanges on customer reserve requirements.

As recessionary pressures mount and the global macroeconomic environment faces ongoing challenges, it remains to be seen how the Fed will respond and whether crypto assets will continue to trade similarly to other higher-risk asset classes, or whether the likes of BTC and ETH will prove to be a haven for investors. There is a silver lining to some of the 2022 challenges. Bad actors and companies are being weeded out. Regulators will need to place more priority on the industry and provide laws that hopefully will make sense for a new, complex asset class. Investments will hopefully flow to companies with experienced, effective management team and sound risk management policies, which will result in higher quality companies providing better products and service to investors and consumers. Companies and investors should continue to educate themselves, monitor new developments closely and proceed with caution in this rapidly evolving space.

For more information about the above article or other business advisory services, contact Nick Wheeler, CPA at (334) 887-7022 or by leaving us a message below.