Organizations of all shapes and sizes have sought to take advantage of government assistance and programs to help their business persevere and maintain operations during the COVID-19 pandemic.

Organizations of all shapes and sizes have sought to take advantage of government assistance and programs to help their business persevere and maintain operations during the COVID-19 pandemic.

For those who have participated, and for potential participants, there are critical considerations to ensure government assistance is viable and worthwhile for your organization, including access to funds, recordkeeping and reporting requirements, flexibility in decision-making, and appropriate oversight.

Understand Your Options

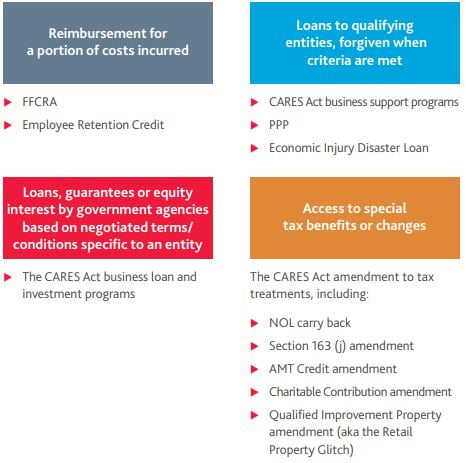

When it comes to government assistance, there are broadly four categories of programs in place, each of which has unique qualifying criteria and resultant recordkeeping responsibilities.

Transparency Trade-off

Businesses have rightfully been focused on whether they can qualify for assistance through the available programs. While each program has different criteria, most small, mid-sized, and even large organizations, are eligible for assistance from at least one program such as the Paycheck Protection Program or Families First Coronavirus Recovery Act.

Eligibility, however, should not be the only consideration. Organizations should weigh all available paths to bolster their liquidity and be advised that any government loan or assistance program will come with significant scrutiny—from both oversight bodies and broader stakeholders. Numerous businesses—from public restaurants to sports teams—have endured significant criticism for accessing assistance for which they are rightfully eligible. Others have made the judgment that the risks of potential damage to their brand and reputation, along with the additional reporting requirements outweigh the benefits of receiving government funds. The considerations and decisions will be different for every organization.

Recordkeeping Considerations

In late April 2020, the current Treasury Secretary said the government would perform a “full audit” on companies taking $2 million or more from the small business loan program.

No matter the size of the assistance, organizations that do choose to take advantage of current and future stimulus packages will need adequate recordkeeping to prove eligibility, obtain loan forgiveness and prepare for a future audit or inquiry by a government agency.

For example, as confirmed by the National Treasury in its FAQ 31, an entity has to qualify to receive monies under the PPP. The SBA may ask an entity to provide its qualifying evidence in the future. If the SBA concludes an entity did not qualify, penalties and repayment of such loans may result, even if the funds were applied to qualifying activities or purposes.

Many of the records necessary to prove these qualifications are detailed, and they require entities to proactively identify those needs, gather records on a contemporaneous basis, and subject records to controls for completeness and accuracy.

For example, the Families First Recovery Act requires businesses to retain records of paid leave that arose from a covered COVID-19 impact in order to support the entity making a claim for reimbursement of the covered paid leave. In addition, the PPP requires 9 different sets of information to be collected over the 8-week period addressed by the PPP in order to prove that the entity qualifies for forgiveness of the loan they obtained.

Four Steps to Reporting Readiness

Anytime funds or benefits are allocated from the government, it is a best practice to plan for transparency, reporting, and oversight. Organizations should take the following steps for thorough recordkeeping.

As organizations document and develop processes, and assign responsibility for recordkeeping, they must ensure executive-level sponsorship and involvement. Many of the loan programs have conditions that could impact a business’ flexibility when making important decisions such as change in headcount, executive pay, and other critical investments for growth in both the short and long term. In addition, multinational organizations likely will be contending with programs and requirements in many jurisdictions as new government support measures are announced across the globe.

Given all of the complexity and the inherent risk, companies may benefit from leveraging internal or external audit procedures and attestation to validate that the initial application conformed to the program requirements and that the recordkeeping is complete, accurate, and compliant.

Reinterpretation is a Reality

Organizations should also be mindful that these programs were enacted with necessary haste, and it’s possible that some areas will be subject to ongoing reassessment or reinterpretation.

For example, in late April, the IRS suggested that PPP funds would not be tax-deductible. The AICPA and other groups are currently seeking to change that rule, but it’s just one instance reinforcing that lack of clarity means thorough documentation and reporting will be critical in the fallout of these programs.

In addition, the FASB is likely to issue guidance for disclosures related to government assistance that could further evolve reporting and recordkeeping needs.

Staying up to date on new opportunities and changes to requirements is essential, as is consulting with advisors to ensure your organization is taking advantage of the right programs and has the right reporting to maximize benefits and minimize risk.

For more information on the above article or any accounting & outsourcing services, contact Nick Wheeler, CPA at (334) 887-7022 or by leaving us a message below.

This article originally appeared in BDO USA, LLP's Insights newsletter. Copyright 2020 BDO USA, LLP. All rights reserved. www.bdo.com