Despite the COVID-19 pandemic, government officials see a significant increase in the number of new businesses being launched. From June 2020 through June 2021, the U.S. Census Bureau reports that business applications are up 18.6%. The Bureau measures this by the number of businesses applying for an Employer Identification Number.

Getting a New Business Off the Ground: How Start-up Expenses Are Handled on Your Tax Return

Posted by Michael D. Machen, CPA, CVA on Jul 23, 2021

Posted in Business Tax

Eligible Businesses: Claim the Employee Retention Tax Credit

Posted by Murry Guy, CPA on Jul 20, 2021

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules.

Posted in Business Tax

10 Facts About the Pass-Through Deduction for Qualified Business Income

Posted by Jessica L. Pagan, CPA on Jul 07, 2021

Are you eligible to take the deduction for qualified business income (QBI)? Here are 10 facts about this valuable tax break: the pass-through deduction, QBI deduction, or Section 199A deduction.

Posted in Business Tax

As we continue to come out of the COVID-19 pandemic, you may be traveling again for business. Under tax law, there are a number of rules for deducting the cost of your out-of-town business travel within the United States. These rules apply if the business conducted out of town reasonably requires an overnight stay.

Posted in Business Tax

Is your business eligible for the ERC?

While the IRS has yet to update its web pages on the new Employee Retention Credit, eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their quarterly employment tax returns, which will be Form 941 for most employers.

Posted in Business Tax

Alabama: Amendment to Electing Pass-Through Entity Tax Act

Posted by Michael D. Machen, CPA, CVA on Jun 21, 2021

Alabama Governor Kay Ivey on May 14, 2021signed House Bill 588 into law, amending the Electing Pass-Through Entity Tax Act ("Act 2021-1") enacted on February 12, 2021. The new law changes the taxable income reporting requirements for pass-through entity (PTE) members and authorizes the Alabama Department of Revenue to waive interest and penalties for underpayments of first-quarter estimated taxes as a result of the bill's retroactive effective date. (For prior coverage of the original version of Act 2021-1, (see Machen McChesney's blog).

Posted in Business Tax

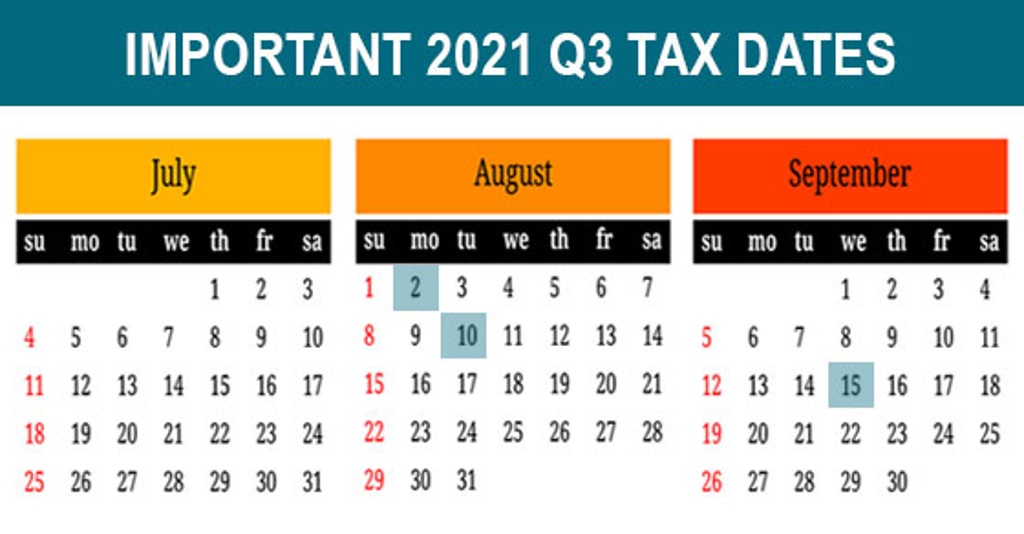

2021 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 15, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Hiring Your Minor Children This Summer? Reap Tax and Nontax Benefits

Posted by Nick Wheeler, CPA on Jun 03, 2021

If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college and learn how to manage money. And you may be able to:

Posted in Business Tax

As state and local governments look for new ways to stimulate their economies, incentivize employment and keep businesses afloat, the pressure for states to generate additional tax revenue continues. In response to this pressure, states are revisiting taxpayers’ compliance with their “nexus” rules and other tax policies and considering new taxes on digital services. In addition, many state governments are reconsidering the extent to which they are willing to conform to federal tax rules and legislation.

Posted in Business Tax

Small and midsize employers, and certain governmental employers, can claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their employees due to COVID-19, including leave taken by employees to receive or recover from COVID-19 vaccinations. These credits are available to eligible employers that paid sick and family leave for leave from April 1, 2021, through September 30, 2021.

Posted in Business Tax