Real Estate Professional - Substantiation of Participation in Activities

Posted by Lesley L. Price, CPA on Jul 21, 2017

Posted in Individual Tax

Numerous tax aspects to consider

Being self-employed has its advantages and disadvantages. As the person in charge of your business affairs, you can set your own schedule and generally have more flexibility than someone in a 9-to-5 job. On the other hand, you are fully responsible for the bottom line, often with little or no backup to rely on.

Posted in Individual Tax

Posted in Individual Tax

Popular ideas for individuals and businesses

While the climate for tax reform remains uncertain, individual taxpayers and small-business owners are advised to act based on the current laws of the land, unless there is a definite change. Keeping that in mind, here are seven ideas to consider as we head into summer.

Posted in Individual Tax

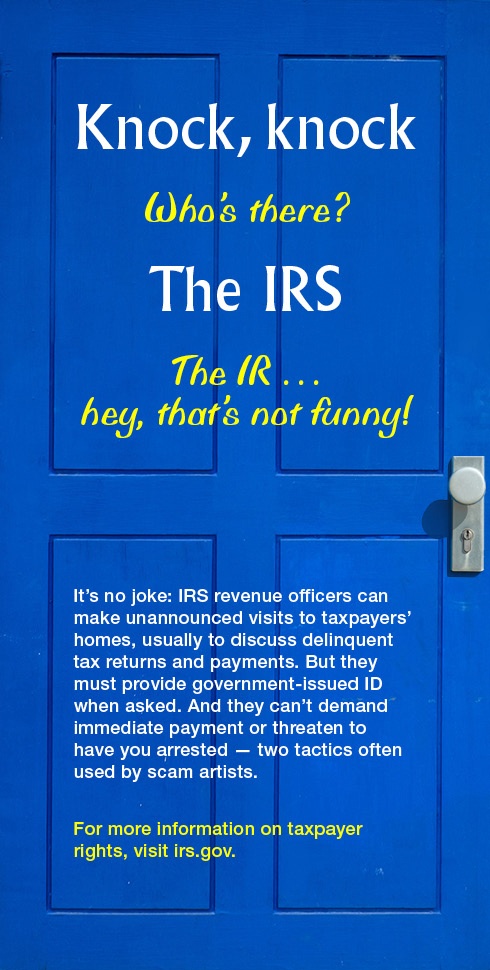

Does the IRS Really Make Unannounced Visits to Taxpayer's Homes?

Posted by Lisa Albritton on Jun 16, 2017

The IRS initiates most contacts through regular mail delivered by the United States Postal Service. However, there are circumstances in which the IRS will call or come to a home or business

Posted in Individual Tax

How will you ever save enough money to pay for your children’s college educations? There are no absolute guarantees, but Section 529 plans may help you set aside funds, up to generous limits. Here are the answers to several common questions on this subject.

Posted in Individual Tax

The IRS recently released its annual list of “Dirty Dozen” tax scams to watch out for in 2017. Here is a rundown gleaned from the IRS’ summary.

Posted in Individual Tax

Do you know the steps to take if you become a victim of identity theft? Now that it has become the fastest growing white collar crime in the U.S, we must all know how to proactively respond to ID theft. Combating the crime of identity theft is for the most part reactionary – in other words, something “bad” has already happened—taking a proactive approach can mitigate any potential future losses.

Posted in Individual Tax

How to avoid underpayment penalties

Even though you just put your 2016 tax return to bed, you cannot rest easy. It is already time to pay attention to your tax liability for 2017. Significantly, you may be required to pay installments of “estimated tax” for this year, especially if you are self-employed or retired.

Posted in Individual Tax

How to maximize the tax benefits

The summer rental season is about to kick off. If you own a vacation home in a resort area that you rent out while your family is not using it, you may be in line for valuable tax deductions. In fact, you might even qualify for a tax loss on the deal, but you must be careful to observe the complex tax rules.

Posted in Individual Tax