There are several different types of tax-free weekend events in the U.S. Some apply to Energy Star products or hurricane preparedness, or back-to-school shopping needs. This year the State of Alabama will be participating in the Back-to-School Sales Tax Holiday Weekend beginning Friday, July 21 through Sunday, July 23.

Michael D. Machen, CPA, CVA

Recent Posts

Machen McChesney In the Top 100 Wealth Management Blogs and Websites on the Web

Posted by Michael D. Machen, CPA, CVA on Jul 06, 2017

Machen McChesney has been chosen by Feedspot to be among the Top 100 Wealth Management blogs and websites.

Posted in Alerts

How Controlling Core Business Costs Can Boost Your Profit Margin

Posted by Michael D. Machen, CPA, CVA on Jun 20, 2017

It’s a near certainty that businesses of any size or scope would seek to reduce costs, if given the chance. And why not? Lowering costs is arguably the most direct way to increase profitability.

Posted in Business Advisory

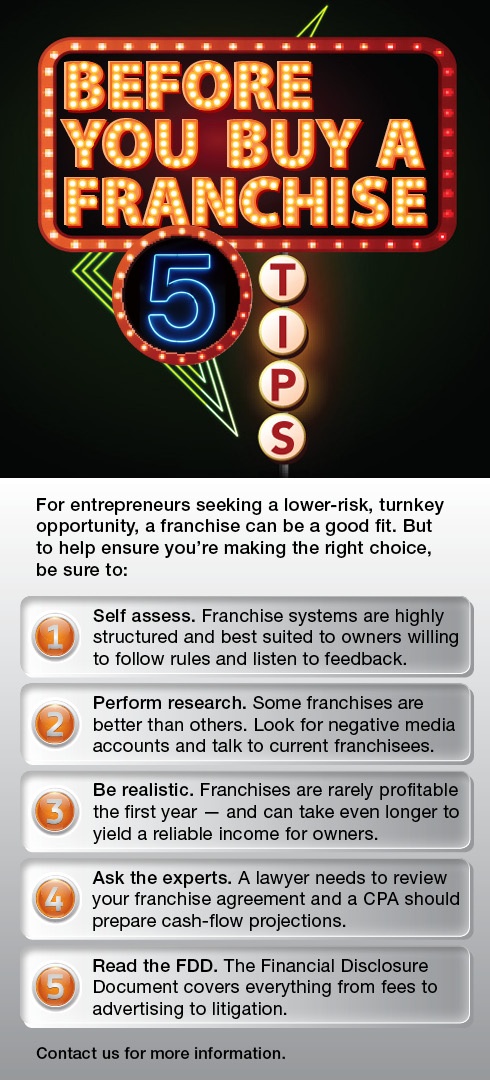

If you are a entrepreneur seeking to buy a franchise these 5 tips may help you ensure you're making the right choice.

Posted in Business Advisory

Tips to Optimize the Value of Your Privately Held Company

Posted by Michael D. Machen, CPA, CVA on May 24, 2017

Say you currently have a direct ownership interest in a privately held company. Or, perhaps your company granted you stock options, stock appreciation rights, or some other type of stock-based compensation. Whatever the circumstances may be, you may consider yourself fortunate; but do you really know what your business interest is worth?

Posted in Business Valuation

How Does Your Restaurant Stack Up Against the Industry?

Posted by Michael D. Machen, CPA, CVA on May 08, 2017

Recently, BDO Alliance USA released their 2014 Restaurant Benchmarking Update. Compiling the operating results of publicly traded restaurant companies, this report looks at costs of sales across all segments for food and beverage.

Posted in Business Advisory

What should small business owners be focused on to ensure a smooth tax season?

While you started 2017 with the best of intentions to keep your financial records organized, you may find yourself scrambling to find receipts and other documentation to prepare your tax returns. All too often it is accounts receivable that presents that greatest challenge.

Posted in Tax Planning

Did You Know Machen McChesney Has a Manufacturing Group?.....

Posted by Michael D. Machen, CPA, CVA on Feb 28, 2017

Machen McChesney offers several industry-specific knowledge and expertise. One of these industries is the Manufacturing, Distribution & Automotive sector. Machen McChesney has the skill set to provide guidance to help your business reduce labor and production cost, help optimize inventory management systems and controls, and the ability to ensure you are paying the correct sales and use tax rates.

Posted in Business Tax

The required rate of return is just one of many components used in the calculations used in corporate finance and equity valuation. It goes beyond identifying the return of the investment, and factors in risk as one of the essential considerations in determining potential return.

Posted in Business Valuation

Did You Know Machen McChesney has a Business Advisory Group? ...

Posted by Michael D. Machen, CPA, CVA on Jan 27, 2017

Machen McChesney has been providing business owners peace of mind by assisting them in a wide array of challenges that exist. We understand that running a business can present a challenging endeavor for any individual to pursue on their own. Our professionals have spent years honing expertise in a wide range of business advisory services and will look for ways to add value to your business.

Posted in Business Advisory