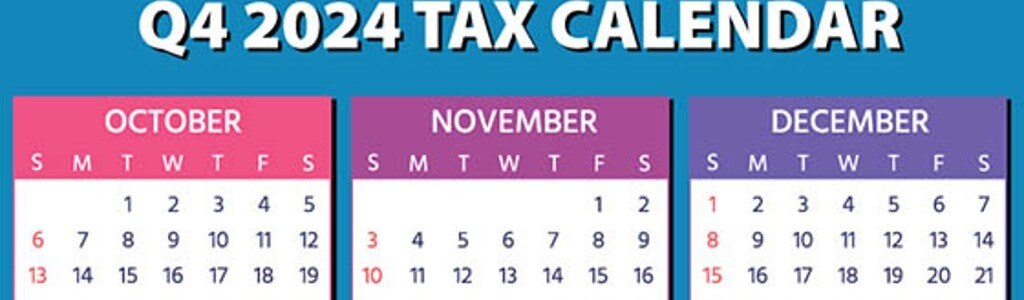

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

2024 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Sep 25, 2024

Posted in Business Tax

Companies and workers had to rapidly adjust and improvise during the first months of the COVID-19 pandemic. Now that work-from-home routines and policies have become more established, employers are creating policies to provide their remote employees with tools for productivity and comfort.

Posted in Payroll, HR & Benefits

Help Ensure Your Partnership or LLC Complies With Tax Law

Posted by Nick Wheeler, CPA on Sep 19, 2024

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to include in your agreement so your business remains in compliance with federal tax law.

Posted in Business Tax

Strong Internal Controls and Audits Can Help Safeguard Against Data Breaches

Posted by Melissa Motley, CPA on Sep 18, 2024

The average cost of a data breach has reached $4.88 million, up 10% from last year, according to a recent report. As businesses increasingly rely on technology, cyberattacks are becoming more sophisticated and aggressive, and risks are increasing. What can your organization do to protect its profits and assets from cyber threats?

Posted in Audit & Assurance

2024 Presidential Election: What's at Stake for the Asset Management Industry

Posted by Marty Williams, CPA on Sep 13, 2024

The 2024 election is likely to profoundly impact tax policy and legislation. Once the dust settles on the results, the incoming president and Congress will have a tall task in 2025, as the expiration of several 2017 Tax Cuts and Jobs Act (TCJA) provisions will loom large, and many other tax policy proposals will be on the table. All of the moving parts have inspired pundits to refer to 2025 as a year we will see the “Super Bowl of Tax”.

Posted in Taxation

It's Time for Your Small Business to Think About Year-End Tax Planning

Posted by Lesley L. Price, CPA on Sep 11, 2024

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or next to maximize their tax value.

Posted in Business Advisory, Business Tax

Reasons an LLC Might Be the Ideal Choice for Your Small Business

Posted by Jessica L. Pagan, CPA on Sep 10, 2024

Choosing the right business entity is a key decision for any business. The entity you pick can affect your tax bill, your personal liability, and other issues. For many businesses, a limited liability company (LLC) is an attractive choice. It can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This duality may provide the owners with several benefits.

Posted in Business Advisory

Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. Perhaps this gain comes from indirect ownership of real estate via a pass-through entity such as an LLC, partnership, or S corporation. You may expect to pay Uncle Sam the standard 15% or 20% federal income tax rate that usually applies to long-term capital gains from assets held for more than one year.

Posted in Individual Tax

According to the National Association of Background Screeners, 95% of U.S. employers use background checks when hiring employees. Background checks cannot look at medical history or genetic information, but they are legal for assessing a person's work history, education, criminal record, financial history, or social media use.

Posted in Payroll, HR & Benefits

Proactive working capital management is essential to successful business operations. However, on average, businesses aren’t managing their working capital as efficiently as they have in the past, according to a new study by The Hackett Group, a digital transformation and AI strategy consulting firm.

Posted in Business Advisory