As we approach 2025, changes are coming to the Social Security wage base. The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $176,100 for 2025 (up from $168,600 for 2024). Wages and self-employment income above this amount aren’t subject to Social Security tax.

Employers: In 2025, the Social Security Wage Base Is Going Up

Posted by Murry Guy, CPA on Oct 23, 2024

Posted in Business Advisory

There are many tax uncertainties to consider as we face the end of 2024. Chief among them is whether proposals from the presidential candidates will affect our taxes; new legislation may be enacted this year, or changes may occur that will be retroactive.

Posted in Business Tax

Any recordkeeping system that suits you and your company and clearly shows your income and expenses is OK with the IRS. It's the business you're in that affects the type of records you need to keep for federal tax purposes.

Posted in Business Tax

Charting the Future of Tax Policy: An Essential Guide for Corporate Boards

Posted by Michael D. Machen, CPA, CVA on Oct 14, 2024

The upcoming U.S. election cycle gives rise to ambiguity in business tax planning. Companies must prepare for a shifting tax landscape while considering differing priorities of Republicans and Democrats regarding U.S. tax policies, such as the approaching expiration of some components of the 2017 Tax Cuts and Jobs Act (TCJA). This environment emphasizes the importance of the board’s oversight role and its understanding of a company's total tax strategy, emerging compliance complexities, the impact of potential election results and associated tax planning scenarios, and the need for a broad perspective on total tax posture and associated social responsibility of the company.

Posted in Business Advisory

Profitable businesses often experience cash flow shortages, particularly if they’re experiencing rapid growth. Business owners may wonder why they owe taxes when they regularly struggle to find cash to cover their bills. The answer can be found by understanding the key differences between profits and cash flow.

Posted in Business Advisory

When reviewing their income statements, business owners tend to focus on profits (or losses). But focusing solely on the bottom line can lead to mismanagement and missed opportunities. Instead, you should analyze this financial report from top to bottom for deeper insights.

Posted in Audit & Assurance

Advantages of Keeping Your Business Separate From Its Real Estate

Posted by Jessica L. Pagan, CPA on Oct 07, 2024

Does your business require real estate for its operations? Or do you hold property titled under your business’s name? It might be worth reconsidering this strategy. With long-term tax, liability, and estate planning advantages, separating real estate ownership from the business may be a wise choice.

Posted in Business Tax

First quiet quitting, now quiet vacationing. What is going on? This is a good question with complicated answers.

Posted in Payroll, HR & Benefits

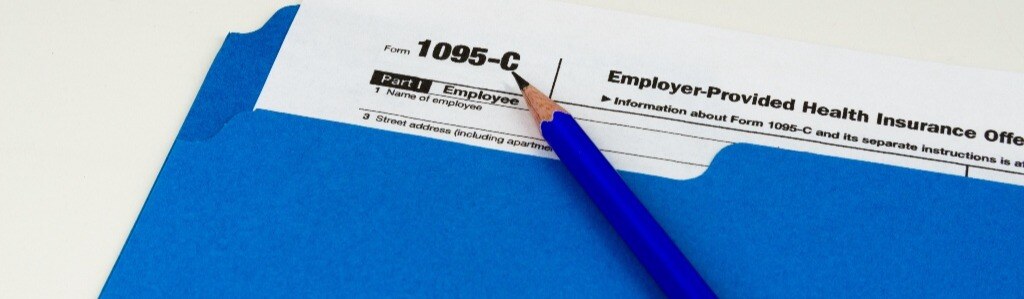

Understanding Your Obligations: Does Your Business Need to Report Employee Health Coverage?

Posted by Murry Guy, CPA on Oct 03, 2024

Employee health coverage is a significant part of many companies’ benefits packages. However, the administrative responsibilities that accompany offering health insurance can be complex. One crucial aspect is understanding the reporting requirements of federal agencies such as the IRS. Does your business have to comply, and if so, what must you do? Here are some answers to questions you may have.

Posted in Business Advisory

Timing is critical in financial reporting. Under accrual-basis accounting, the end of the accounting period serves as a “cutoff” for when companies recognize revenue and expenses. However, some companies may be tempted to play timing games, especially at year-end, to boost financial results or lower taxes.

Posted in Business Advisory