Merger and acquisition activity dropped dramatically last year due to rising interest rates and a slowing economy. The total value of M&A transactions in North America in 2022 was down 41.4% from 2021, according to S&P Global Market Intelligence.

Posted in Payroll, HR & Benefits

Accounting is a critical element when launching a successful business venture. Unfortunately, it’s also an area where startups tend to make mistakes. Here are some common (and avoidable) errors that entrepreneurs should watch out for.

Posted in Taxation

Treasury, IRS Release Additional Information on Clean Vehicle Provisions of Inflation Reduction Act

Posted by Michael D. Machen, CPA, CVA on Feb 08, 2023

The U.S. Treasury Department and the IRS, on December 29, 2022, released information on the clean vehicle provisions of the Inflation Reduction Act. The new guidance provides greater clarity to consumers and businesses that, beginning January 1, 2023, are able to access tax benefits from the law’s clean vehicle provisions.

Posted in Business Tax

Have Employees Who Receive Tips? Here Are the Tax Implications

Posted by Murry Guy, CPA on Feb 07, 2023

Many businesses in certain industries employ individuals who receive tips as part of their compensation. These businesses include restaurants, hotels, and salons.

Posted in Accounting & Outsourcing

Many Tax Limits Affecting Businesses Have Increased For 2023

Posted by Lesley L. Price, CPA on Feb 03, 2023

An array of tax-related limits that affect businesses are indexed annually, and due to high inflation, many have increased more than usual for 2023. Here are some that may be important to you and your business.

Posted in Business Tax

Planning to Deduct for Losses This Tax Season? Be Sure to Read the Fine Print.

Posted by Lesley L. Price, CPA on Jan 26, 2023

Deducting losses is a high-priority item for taxpayers in the highest marginal income tax bracket. The topic will be especially relevant during the 2022 tax compliance season because of recent declines in the stock market and a challenging overall business environment.

Posted in Business Tax

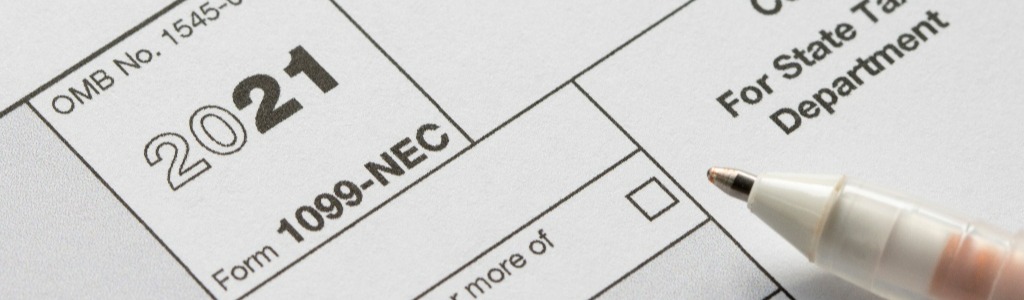

With the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. By January 31, 2023, employers must file these forms:

Posted in Accounting & Outsourcing

CPA firms do more than audits and tax returns. They can also help you with everyday accounting-related tasks, such as bookkeeping, budgeting, payroll, and sales tax filings. Should your organization outsource its accounting needs? Here are five potential advantages to consider when evaluating this decision.

Posted in Business Advisory

There's been buzz about new retirement plan provisions for weeks, and now they're final, bringing about changes to various federal rules and adding flexibility for current and future retirees. The Secure 2.0 Act of 2022, part of the Consolidated Appropriations Act of 2023, includes the following modifications, some of which are immediate and others that will take effect in the future.

Posted in Business Advisory