Businesses need financial information that’s accurate, relevant, and timely. The Securities and Exchange Commission requires publicly traded companies to follow U.S. Generally Accepted Accounting Principles (GAAP), often considered the “gold standard” in financial reporting in the United States. But privately held companies can use simplified alternative accounting methods. What’s right for your business depends on its size, regulatory and contractual requirements, management’s future plans, and the needs of its stakeholders.

Is your business eligible for the ERC?

While the IRS has yet to update its web pages on the new Employee Retention Credit, eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their quarterly employment tax returns, which will be Form 941 for most employers.

Posted in Business Tax

Paperless payroll is a paper-free payroll process that has become hugely popular in recent years. But despite the groundswell of support for paperless payroll solutions, employers should examine the details before making the switch.

Posted in Payroll, HR & Benefits

Alabama: Amendment to Electing Pass-Through Entity Tax Act

Posted by Michael D. Machen, CPA, CVA on Jun 21, 2021

Alabama Governor Kay Ivey on May 14, 2021signed House Bill 588 into law, amending the Electing Pass-Through Entity Tax Act ("Act 2021-1") enacted on February 12, 2021. The new law changes the taxable income reporting requirements for pass-through entity (PTE) members and authorizes the Alabama Department of Revenue to waive interest and penalties for underpayments of first-quarter estimated taxes as a result of the bill's retroactive effective date. (For prior coverage of the original version of Act 2021-1, (see Machen McChesney's blog).

Posted in Business Tax

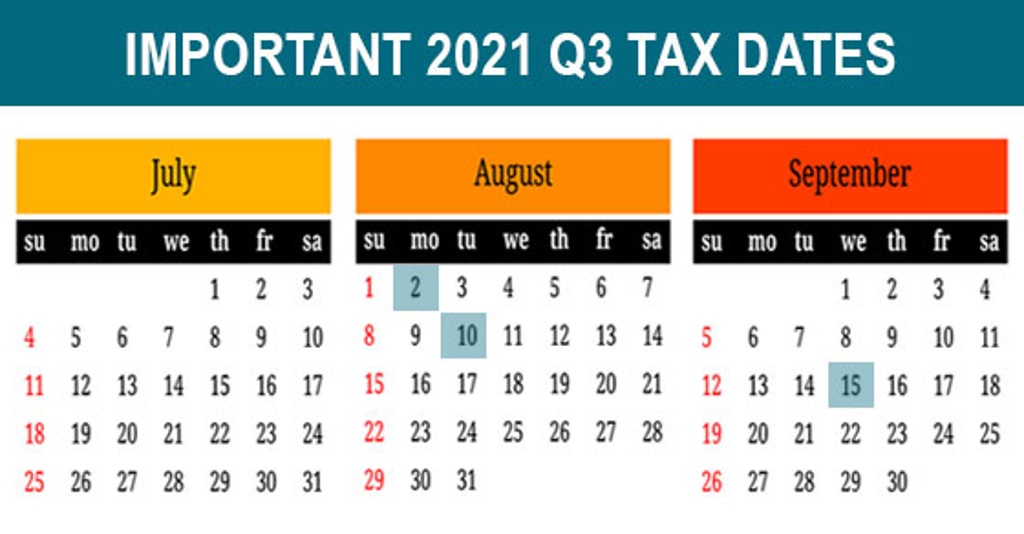

2021 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 15, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Internal controls are a system of policies and procedures organizations put in place to protect assets and improve operating efficiency. Effective internal controls are critical to accurate financial reporting. A solid system of controls can help prevent, detect and correct financial misstatements due to errors and fraud.

Posted in Audit & Assurance

Hiring Your Minor Children This Summer? Reap Tax and Nontax Benefits

Posted by Nick Wheeler, CPA on Jun 03, 2021

If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college and learn how to manage money. And you may be able to:

Posted in Business Tax

As state and local governments look for new ways to stimulate their economies, incentivize employment and keep businesses afloat, the pressure for states to generate additional tax revenue continues. In response to this pressure, states are revisiting taxpayers’ compliance with their “nexus” rules and other tax policies and considering new taxes on digital services. In addition, many state governments are reconsidering the extent to which they are willing to conform to federal tax rules and legislation.

Posted in Business Tax

Many companies are continuing to struggle financially during the COVID-19 pandemic. If cash is tight, what can your business do to shorten its cash cycle? The answer could lie in your outstanding accounts receivable. Here are five strategies to help convert receivables into cash ASAP.

Posted in Business Advisory

Using Your Financial Statements to Evaluate Capital Budgeting Decisions

Posted by Nick Wheeler, CPA on May 24, 2021

Strategic investments — such as expanding a plant, purchasing a major piece of equipment, or introducing a new product line — can add long-term value. But management shouldn’t base these decisions on gut instinct. A comprehensive, formal analysis can help minimize the guesswork and maximize your return on investment.

Posted in Business Advisory