The Financial Accounting Standards Board (FASB) recently gave private companies long-awaited relief from one of the most complicated aspects of financial reporting — consolidation of variable interest entities (VIEs). Here are the details.

Time To Celebrate! FASB Expands VIE Exception For Private Companies

Posted by Aaron K. Waller, CPA on Jan 03, 2019

Posted in Audit & Assurance

A Refresher On Major Tax Law Changes For Small-business Owners

Posted by Nick Wheeler, CPA on Jan 02, 2019

The dawning of 2019 means the 2018 income tax filing season will soon be upon us. After year end, it’s generally too late to take action to reduce 2018 taxes. Business owners may, therefore, want to shift their focus to assessing whether they’ll likely owe taxes or get a refund when they file their returns this spring, so they can plan accordingly.

Posted in Business Tax

Tax planning is a year-round activity, but there are still some year-end strategies you can use to lower your 2018 tax bill. Here are six last-minute tax moves business owners should consider:

Posted in Business Tax

How To Prepare For Year-end Physical Inventory Counts

Posted by Aaron K. Waller, CPA on Dec 17, 2018

As year-end approaches, it’s time for calendar-year entities to perform physical inventory counts. This activity is more than a compliance chore. Proactive companies see it as an opportunity to improve operational efficiency.

Posted in Audit & Assurance

Is Running a Nonprofit With a For-Profit Vision the New Normal?

Posted by Lesley L. Price, CPA on Dec 12, 2018

Posted in Business Tax

The U.S. population is aging and, as it does, the need for long-term support and services will only grow. According to a 2017 fact sheet from the AARP Public Policy Institute, on average, 52% of people who turn 65 today will develop a severe disability that will require long-term care (LTC) at some point. For this reason, among others, employers should consider offering LTC insurance as a fringe benefit.

Posted in Payroll, HR & Benefits

Accurate overhead allocations are essential to understanding financial performance and making informed pricing decisions. Here’s guidance on how to estimate overhead rates to allocate these indirect costs to your products and how to adjust for variances that may occur.

Posted in Business Tax

Every year, when baseball season finally ends, a most valuable player (MVP) is named in each league. Not everyone agrees on the choice; in fact, it’s something fans love to argue about. But eventually the two players receive their awards and their names go into the record books.

Posted in Payroll, HR & Benefits

Help Employees Take Flight With a Performance Management Pilot Program

Posted by Becky Snedigar on Dec 06, 2018

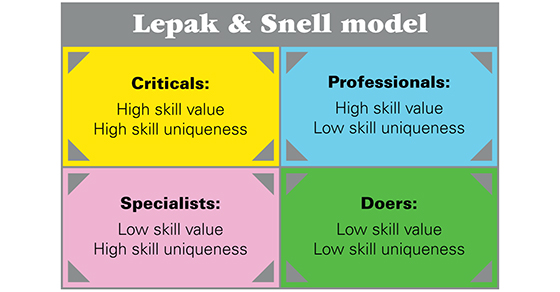

Many years ago, “performance management” was a supervisor giving orders to an employee and the employee trying to follow them. But as the workplace has evolved and employers have sought to get a greater return on investment in human resources, the concept of performance management has become much more complex.

Posted in Payroll, HR & Benefits

Roth 401(k) accounts have been around for quite a while. But many employers still don’t offer them and many employees still don’t understand them. As the name implies, these plans are a hybrid — taking some characteristics from Roth IRAs and some from traditional employer-sponsored 401(k)s. When considering (or reconsidering) your retirement plan options, look into whether a Roth 401(k) would suit your employees.

Posted in Payroll, HR & Benefits