If you acquire a company, your to-do list will be long, which means you can’t devote all of your time to the deal’s potential tax implications. However, if you neglect tax issues during the negotiation process, the negative consequences can be serious. To improve the odds of a successful acquisition, it’s important to devote resources to tax planning before your deal closes.

Could Captive Insurance Reduce Health Care Costs and Save Your Business Taxes?

Posted by Michael D. Machen, CPA, CVA on Aug 21, 2017

If your business offers health insurance benefits to employees, there’s a good chance you’ve seen a climb in premium costs in recent years — perhaps a dramatic one. To meet the challenge of rising costs, some employers are opting for a creative alternative to traditional health insurance known as “captive insurance.” A captive insurance company generally is wholly owned and controlled by the employer. So it’s essentially like forming your own insurance company. And it provides tax advantages, too.

Posted in Business Advisory

Posted in Business Advisory

Posted in Business Advisory

Posted in Business Advisory

Does Your Company Have an Effective Anti-Fraud Policy?

Posted by Aaron K. Waller, CPA on Jun 22, 2017

With all the buzz about cyberattacks and cyberthreats, it’s all too easy to take your eyes off of a common threat that is much closer to home—fraud that occurs within your own organization. While no business owner wants to think about embezzlement occurring within their own employee population, it can and does happen on a frequent basis.

Posted in Business Advisory

How Controlling Core Business Costs Can Boost Your Profit Margin

Posted by Michael D. Machen, CPA, CVA on Jun 20, 2017

It’s a near certainty that businesses of any size or scope would seek to reduce costs, if given the chance. And why not? Lowering costs is arguably the most direct way to increase profitability.

Posted in Business Advisory

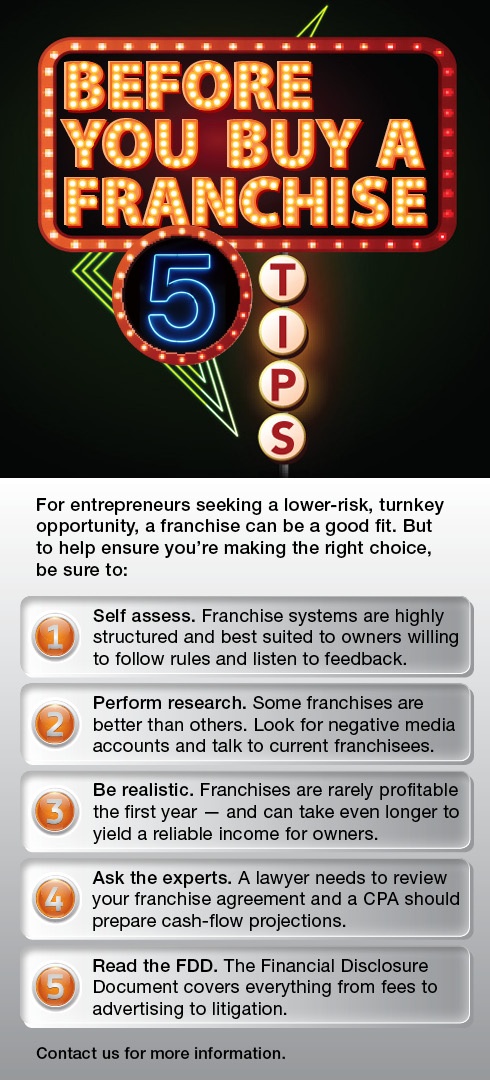

If you are a entrepreneur seeking to buy a franchise these 5 tips may help you ensure you're making the right choice.

Posted in Business Advisory

How Does Your Restaurant Stack Up Against the Industry?

Posted by Michael D. Machen, CPA, CVA on May 08, 2017

Recently, BDO Alliance USA released their 2014 Restaurant Benchmarking Update. Compiling the operating results of publicly traded restaurant companies, this report looks at costs of sales across all segments for food and beverage.

Posted in Business Advisory

Did You Know Machen McChesney has a Business Advisory Group? ...

Posted by Michael D. Machen, CPA, CVA on Jan 27, 2017

Machen McChesney has been providing business owners peace of mind by assisting them in a wide array of challenges that exist. We understand that running a business can present a challenging endeavor for any individual to pursue on their own. Our professionals have spent years honing expertise in a wide range of business advisory services and will look for ways to add value to your business.

Posted in Business Advisory

-197431-edited.jpg)