The Financial Accounting Standards Board (FASB) made favorable changes to the accounting rules for crypto assets in December 2023. The updated guidance benefits reporting entities and external stakeholders alike. It’s effective for fiscal years beginning after December 15, 2024, including interim periods within those years. Here’s what you should know — and why many companies are choosing to implement the changes before they’re required to do so.

Now or Later: When Should Your Company Implement the New Crypto Reporting Guidance?

Posted by Lesley L. Price, CPA on Jan 09, 2025

Posted in Business Tax

Intangible assets, such as patents, trademarks, copyrights, and goodwill, play a crucial role in today’s businesses. The tax treatment of these assets can be complex, but businesses need to understand the issues involved. Here are some answers to frequently asked questions.

Posted in Business Tax

In today's evolving U.S. and global tax environment, the tax implications of business decisions are not always intuitive. Integrating tax considerations throughout the decision-making process can help businesses unlock potential tax savings and efficiencies as well as identify and mitigate tax risks. Whether shifting supply chains, pursuing mergers and acquisitions, implementing sustainability initiatives, or adjusting workforce strategy — embracing a total tax mindset while modeling the tax impact of these decisions can lead to better outcomes that add value to your organization.

Posted in Business Tax

From Flights to Meals: A Guide to Business Travel Tax Deductions

Posted by Nick Wheeler, CPA on Nov 14, 2024

As a business owner, you may travel to visit customers, attend conferences, check on vendors, and for other purposes. Understanding which travel expenses are tax deductible can significantly affect your bottom line. Properly managing travel costs can help ensure compliance and maximize your tax savings.

Posted in Business Tax

There are many tax uncertainties to consider as we face the end of 2024. Chief among them is whether proposals from the presidential candidates will affect our taxes; new legislation may be enacted this year, or changes may occur that will be retroactive.

Posted in Business Tax

Any recordkeeping system that suits you and your company and clearly shows your income and expenses is OK with the IRS. It's the business you're in that affects the type of records you need to keep for federal tax purposes.

Posted in Business Tax

Advantages of Keeping Your Business Separate From Its Real Estate

Posted by Jessica L. Pagan, CPA on Oct 07, 2024

Does your business require real estate for its operations? Or do you hold property titled under your business’s name? It might be worth reconsidering this strategy. With long-term tax, liability, and estate planning advantages, separating real estate ownership from the business may be a wise choice.

Posted in Business Tax

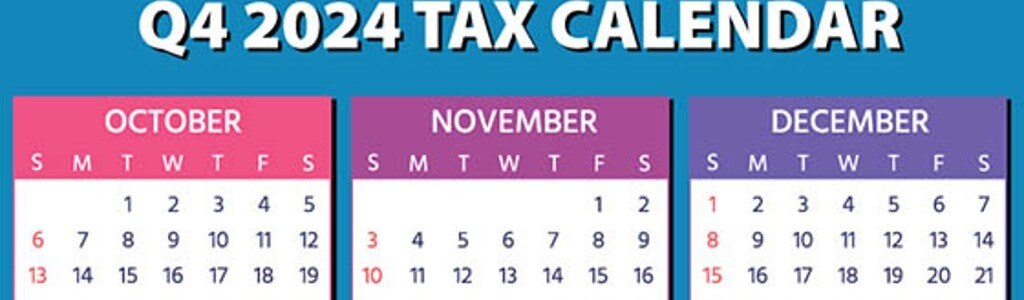

2024 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Sep 25, 2024

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Help Ensure Your Partnership or LLC Complies With Tax Law

Posted by Nick Wheeler, CPA on Sep 19, 2024

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to include in your agreement so your business remains in compliance with federal tax law.

Posted in Business Tax

It's Time for Your Small Business to Think About Year-End Tax Planning

Posted by Lesley L. Price, CPA on Sep 11, 2024

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or next to maximize their tax value.

Posted in Business Advisory, Business Tax