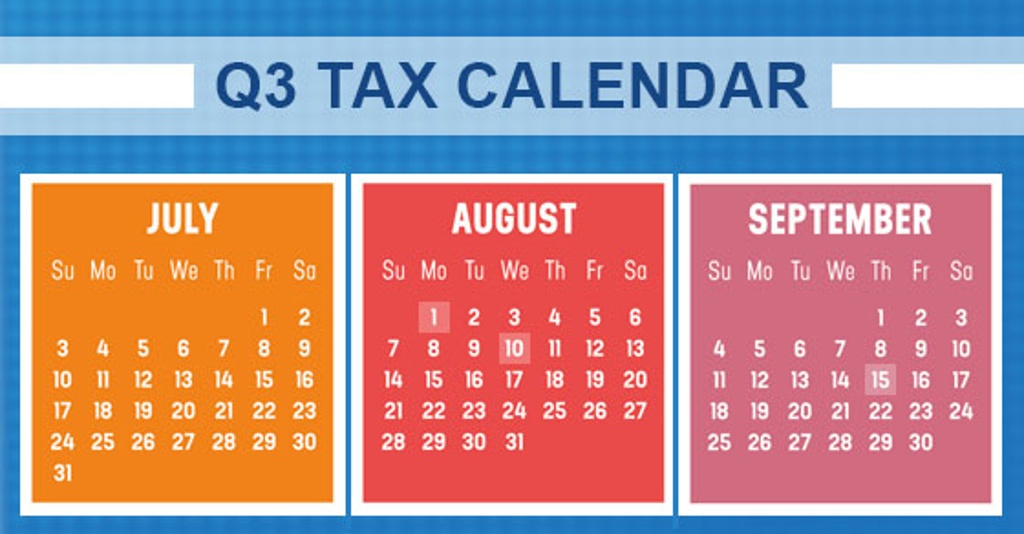

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

2022 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 27, 2022

Posted in Taxation

Construction Ahead: Opportunities and Challenges in 2022

Posted by Michael D. Machen, CPA, CVA on Jun 23, 2022

The Infrastructure Investment and Jobs Act (H.R. 3684) will inject approximately $3 trillion into upgrading and expanding U.S. infrastructure, presenting a long horizon of opportunity for the construction industry.

Posted in Business Advisory

Finding talent is an issue for nearly all businesses. There are many reasons for this, but the top three may be (1) adjusting to a new normal that is not yet fully formed, (2) the generational shift in leadership, and (3) the scarcity of talent. The result of this confluence of issues is that leaders must be able to be flexible. One of the ways they need to be flexible is learning new ways to manage a multigenerational workforce.

Posted in Payroll, HR & Benefits

Warning for Retailers and Other Businesses Using the LIFO Method

Posted by Jessica L. Pagan, CPA on Jun 21, 2022

Recent supply shortages may cause unexpected problems for some businesses that use the last-in, first-out (LIFO) method for their inventory. Here’s an overview of what’s happening so you won’t be blindsided by the effects of so-called “LIFO liquidation.”

Posted in Business Tax

Year-End Planning for the Solar Energy Investment Tax Credit

Posted by Lesley L. Price, CPA on Jun 17, 2022

Solar energy is a popular choice for businesses looking to reduce their carbon footprint through alternative energy sources. In addition to supporting a company’s environmental, social, and governance (ESG) strategy, converting to solar energy can potentially lock-in lower energy rates. Further, Section 48 of the Internal Revenue Code provides businesses that invest in solar energy a 26% Investment Tax Credit (ITC) on qualifying solar property placed in service before January 1, 2026 — but only if construction begins on the property before January 1, 2023. Otherwise, the credit is phased down to as low as 10%.

Posted in Business Tax

As the COVID-19 pandemic wears on, trends in the life insurance industry remain unpredictable. Policy sales have changed substantially, payouts have soared to levels not seen in over a century, and clients have grown more accustomed to personalized digital experiences. As COVID-19 vaccination rates rise and the economic recovery continues, life insurers are embracing new digital practices to meet a new set of customer expectations.

Posted in News & Events

IRS Boosts Standard Cents-Per-Mile Rates for July 1 Through December 31, 2022

Posted by Murry Guy, CPA on Jun 15, 2022

For the final six months of 2022, the standard mileage rate for business travel will increase by 4 cents per mile, from 58.5 to 62.5 cents per mile, according to IRS Announcement 2022-13. The rate for deductible medical or moving expenses will likewise increase from 18 to 22 cents per mile.

Posted in Alerts

Is Your Corporation Eligible for the Dividends-Received Deduction?

Posted by Jessica L. Pagan, CPA on Jun 14, 2022

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” is designed to reduce or eliminate an extra level of tax on dividends received by a corporation. As a result, a corporation will typically be taxed at a lower rate on dividends than on capital gains.

Posted in Business Tax

Do you outsource HR and IT but feel squeamish about letting someone else get too close to your numbers? You probably have a fluctuating need for a bookkeeper, an accountant, a controller, and a chief financial officer. You could hire all these people, but outsourcing can provide these services when you need them at significant cost savings.

Posted in Payroll, HR & Benefits

Help When Needed: Apply the Research Credit Against Payroll Taxes

Posted by Marty Williams, CPA on Jun 07, 2022

Here’s an interesting option if your small company or start-up business is planning to claim the research tax credit. Subject to limits, you can elect to apply all or some of any research tax credits that you earn against your payroll taxes instead of your income tax. This payroll tax election may influence some businesses to undertake or increase their research activities. On the other hand, if you’re engaged in or are planning to engage in research activities without regard to tax consequences, be aware that some tax relief could be in your future.

Posted in Business Advisory