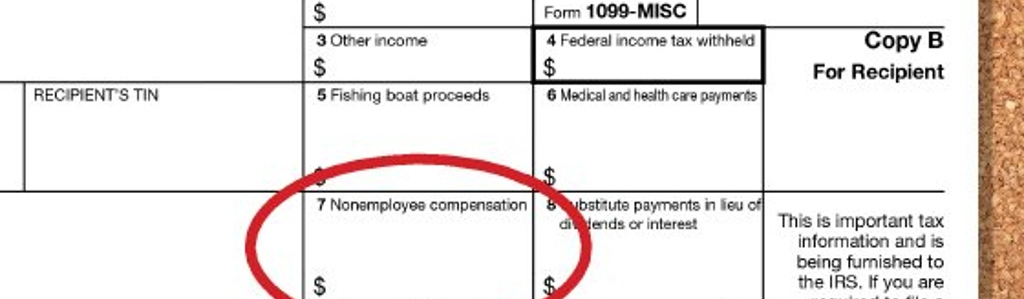

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors, and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time-consuming and there are penalties for not complying, so it’s a good idea to begin gathering information early to help ensure smooth filing.

Small Businesses: Get Ready for Your 1099-MISC Reporting Requirements

Posted by Nick Wheeler, CPA on Nov 13, 2019

Posted in Accounting & Outsourcing

Thinking About Converting from a C Corporation to an S Corporation?

Posted by Jessica L. Pagan, CPA on Nov 08, 2019

The right entity choice can make a difference in the tax bill you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some circumstances, there are plenty of potentially expensive tax problems that you should assess before making the decision to convert from a C corporation to an S corporation.

Posted in Business Advisory

Whether it’s hard hats and drills on a job-site, iPads in an office or RFID readers in a warehouse, small tools and equipment have a tendency to disappear at many companies. The cost of lost, damaged and stolen items can quickly add up, consuming profits and cash flow. What can you do to manage these items more effectively and create accountability among workers?

Posted in Audit & Assurance

Walking on Eggshells: ERISA Compliance Depends on Plan Documents

Posted by Amber Cochran Saxon on Nov 05, 2019

The Employee Retirement Income Security Act (ERISA) covers both defined-benefit and defined-contribution retirement plans. If your organization offers its employees either, you may feel like you’re constantly walking on eggshells trying to oversee all the regulatory details involved. One critical way to stay in compliance and avoid costly penalties is to ensure your plan operates consistently with its plan documents.

Posted in Payroll, HR & Benefits

Small Businesses: Stay Clear of a Severe Payroll Tax Penalty

Posted by Murry Guy, CPA on Nov 05, 2019

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time.

Posted in Accounting & Outsourcing

In financial reporting, investors and business owners tend to focus on four key metrics: 1) revenue, 2) net income, 3) total assets and 4) net worth. But, when it comes to gauging short-term financial performance and creditworthiness, the trump card is cash flow.

Posted in Audit & Assurance

Accelerate Depreciation Deductions with a Cost Segregation Study

Posted by Michael D. Machen, CPA, CVA on Oct 21, 2019

Is your business depreciating over a 30-year period the entire cost of constructing the building that houses your operation? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits of a cost segregation study are now even greater than they were a few years ago due to enhancements to certain depreciation-related tax breaks.

Posted in Taxation

How to Treat Your Business Website Costs for Tax Purposes

Posted by Nick Wheeler, CPA on Oct 17, 2019

These days, most businesses need a website to remain competitive. It’s an easy decision to set one up and maintain it. But determining the proper tax treatment for the costs involved in developing a website isn’t so easy.

Posted in Business Tax

Nonprofits:New Alternatives for Reporting Goodwill & Other Intangibles

Posted by Lesley L. Price, CPA on Oct 15, 2019

Did you know that the Financial Accounting Standards Board (FASB) recently extended the simplified private-company accounting alternatives to not-for-profit organizations? Many merging nonprofits, including educational institutions and hospitals, welcome these practical expedients. Here are the details.

Posted in Business Tax

New Rule will affect millions - After the 2016 regulation (which had a much higher threshold) was invalidated by a U.S. District Court, a new regulation was finalized on September 24, 2019, by the U.S. Department of Labor. However, changes in the regulations do not formally take effect until January 1, 2020. Because of that, employers still have time to make the adjustments necessary to be in full compliance.

Posted in Business Advisory

-1.png)